Happy Thursday, GoldBuzzers!

Today we're wading into one of the spiciest debates in finance - and one that's been filling up my inbox lately. With the U.S. national debt blowing past $38.5 trillion, the case for holding assets outside the government's printing press has never been louder.

But which ones? Gold and Bitcoin both claim the "safe haven" crown - so we're putting them head to head and asking the question: if you had $100k to deploy right now, where should it go?

Let's get into it. 👇

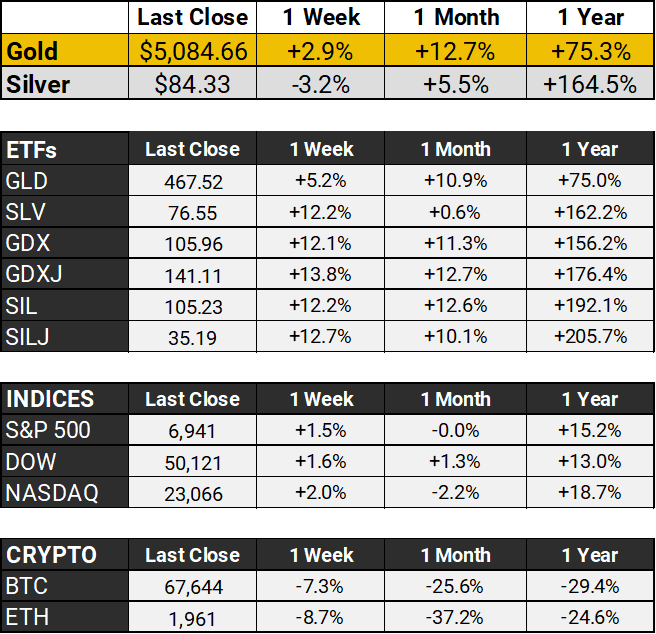

The Scoreboard 🏆

Gold settled around $5,084 on Wednesday, as an exceptionally positive jobs report reminded markets that the Fed isn't in any rush to slash rates. January nonfarm payrolls came in at 130K - nearly double what analysts expected and a big bounce from December's revised 48K - while unemployment dipped to 4.3% and wages climbed 0.4% month-over-month, pushing annual growth to 3.7%.

The data was enough to nudge the next fully priced 25 bps cut from June out to July, giving Treasury yields a lift. But the bigger picture hasn't changed. The easing cycle is coming, geopolitical risk isn't going anywhere, and the PBoC keeps stacking - extending its buying streak yet again. A strong jobs print slows the train, but it doesn't derail it.

Silver stole the spotlight with a 4%+ surge to around $84.30 as the white metal's dual personality - part precious, part industrial - continues to give it an edge. With retail sales previously flatlining and growth signals still sending mixed messages, silver's safe-haven appeal remains very much intact. Add in the broader rate-cut trajectory that markets are still banking on for later this year, and silver looks well-positioned to ride this wave - even if the day-to-day swings keep things interesting.

With the Shanghai Gold Exchange closing from tomorrow night for Chinese New Year, and not reopening until February 24th, it remains to be seen what our friends at the Comex might have in store next week!

Real Talk 🎯

$100k to Park Right Now: Gold or Bitcoin?

The U.S. national debt just crossed $38.5 trillion - $113,000 per person, growing at $6.4 billion per day. Interest payments alone are on track to exceed $1 trillion this year.

Governments don't pay down debts like this. They inflate their way out. They always have.

So it's no surprise that assets outside the government's printing press are catching bids. Gold is back above $5,000 an ounce. Bitcoin peaked near $126,000 last October, before sliding hard. Both are pitched as protection from a debasing dollar - but they're telling very different stories right now.

So if you had $100k to put somewhere today, which one deserves it?

Gold: The 5,000-Year Track Record

As I write this, Gold is up roughly 17% year-to-date (despite the late January correction) and 75% over the past 12 months. In 2025, gold surged 64%. Over the past decade, it's returned about 300%, turning $100k into roughly $400,000.

The key difference is that it did this with drawdowns rarely exceeding 15%. You slept at night.

The buyers driving this rally aren't just retail investors reading newsletters (though welcome, you have good taste!) Central banks are hoovering up gold at record levels - China's PBoC just extended its buying streak to 15 consecutive months.

It’s highly significant that the people in charge of printing money are stacking gold like it's going out of style, that says a lot about how much they trust the money they're printing.

Gold's volatility runs 10-15% annually - boring by crypto standards, beautiful by "I'd like to keep my wealth" standards. It generates no yield, true. But when government bonds are IOUs from an entity $38.5 trillion in the hole, "no yield" beats "negative real yield dressed up in a suit."

Bitcoin: The Rollercoaster With a Thesis

I'll give Bitcoin credit: the long-term numbers are insane. Over a decade, BTC returned north of 20,000%. The CAGR is around 62%.

But the "digital gold" narrative? It's got a problem.

Bitcoin is trading around $67,000 - down roughly 23% year-to-date and 45% off its all-time high. While gold climbed 17% in the first six weeks of 2026, Bitcoin was getting hammered. Trading volumes have dropped 30% since late 2025. Retail investors are quietly heading for the exits.

That's not what "digital gold" is supposed to do when the world gets scary. Gold runs toward fear. Bitcoin, despite 15 years of promises, still runs away from it.

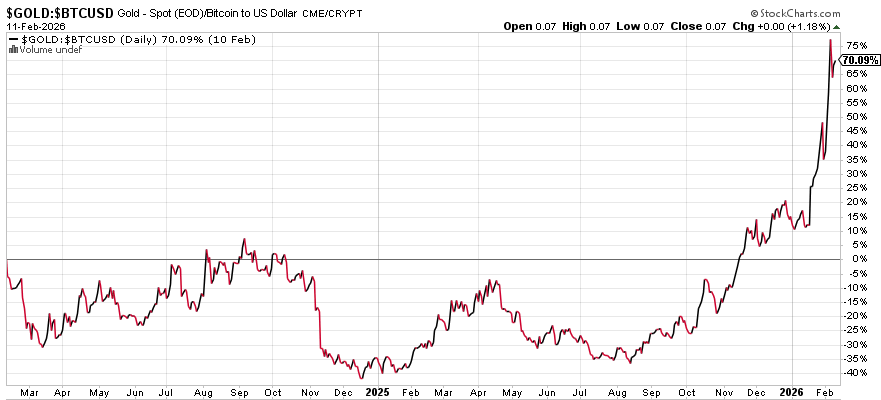

GOLD - BITCOIN Ratio

Since Bitcoin peaked in October, Gold’s relative outperformance has been massive, as you can see in the ratio chart above.

And then there's the elephant in the room - or, more accurately, the convicted sex offender in the blockchain. DOJ files released just last week revealed that Jeffrey Epstein was an early investor in Coinbase ($3 million in 2014, after his first conviction), put money into Bitcoin infrastructure company Blockstream - whose co-founders were invited to his island - and had a close relationship with Tether co-founder Brock Pierce.

Epstein's network also funneled hundreds of thousands to MIT's Digital Currency Initiative, described at the time as Bitcoin's "principal home and funding source."

No, that doesn't mean Bitcoin itself is broken. The open-source protocol doesn't care who funded early development. But it does take some shine off the origin story. Crypto loves the tale of scrappy cypherpunks building freedom money in their garages. Turns out, some of that early funding came from a very different kind of island than the one Satoshi's whitepaper envisioned. Gold doesn't have a founding investor. It doesn't need one.

Wall Street firm Bernstein just reiterated a $150,000 target for Bitcoin by year-end, calling this "the weakest bear case in its history." Maybe they're right on a long enough timeline. But "the weakest bear case" still means watching a quarter of your investment evaporate in six weeks, while the gold in your safe quietly appreciates.

The Verdict

In 2025, the year the debt spiral became impossible to ignore, gold was up 64%. Bitcoin was down 5%. When it actually mattered, gold showed up. Bitcoin didn't.

If I had to pick one place to park $100k in February 2026, I'd want the asset that's been proving its worth since long before anyone had to explain what a blockchain was.

For what it's worth, I’m not personally opposed to Bitcoin at all. In fact, it’s going to be one of the core investment assets we'll be covering in the upcoming GoldBuzz Insider - our premium Theseus-powered signals service. One of our beta testers is a long-time Bitcoin bull and early adopter, and he's been highly impressed with how the system has navigated Bitcoin’s volatility over the past year.

Gold isn't exciting. It doesn't have a whitepaper. It won't 10x this year. But it'll be here - holding its value, trusted for 5,000 years and counting - long after the latest crypto cycle has run its course.

Sometimes boring is beautiful.

📦 Recommended Resources

Services I use and recommend

🇺🇸 Gold IRA - Augusta Precious Metals ⭐ read my review

Allocated Storage - BullionVault

🇨🇦 🇺🇸 Physical Delivery - Silver Gold Bull, Sprott Money

That’s all for this Thursday, folks. See you on Sunday.

Before you go, please take a moment to rate today’s newsletter and let us know how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com