Welcome GoldBuzzers!

Well, we made it. This is our final edition of 2025, and what a year it’s been.

When I launched GoldBuzz back in August, I told you we were in the early innings of a historic precious metals bull market. I told you that the Theseus research had flashed a major breakout signal. I told you to pay attention while everyone else was distracted.

That said, there's no victory lap here. Gold doesn't hit 50 all-time highs in a year because the world is healthy. It does so because people are losing faith in the systems they once trusted. We were prepared - but the reasons we needed to be are sobering.

Let’s recap.

This Year’s Vibe 😂

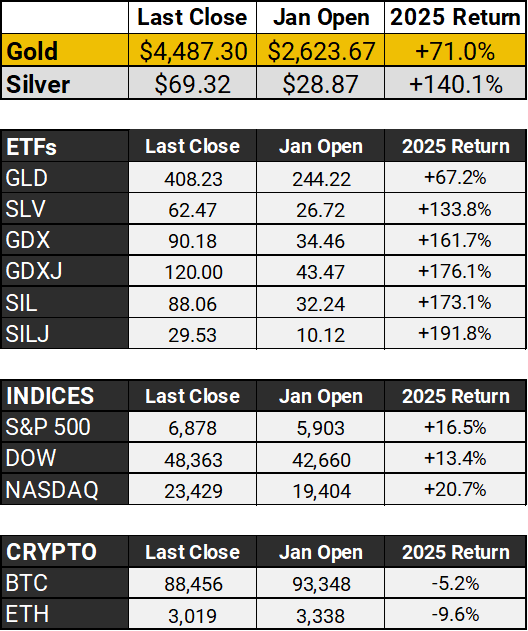

The 2025 Scoreboard 🏆

These are stunning numbers. Gold's best year since 1979. Silver almost doubled Gold’s return - up 140%. The miners? They didn't just beat the S&P - they lapped it 10 times over. And, crypto had a year to forget.

2025 Year in Review

2025 has been a truly momentous year. Here are some of the highlights.

📅 THE YEAR IN MILESTONES

March 14-17: Gold smashes through $3,000 for the first time in history

April 2: "Liberation Day" tariffs trigger global market chaos - gold surges as the ultimate safe haven

April 22: Gold briefly touches $3,500

September 17: Fed cuts rates for the first time in 2025, igniting another rally

October 7-8: Gold blasts through $4,000 amid government shutdown fears

October 9: Silver blasts through $50, finally taking out the 1980 high

October 17: Gold hits all-time high of $4,530

December: Silver hits record $69

Gold has set more than 50 all-time highs in 2025. Fifty. The move from $3,500 to $4,000 took just 36 days - compared to an average of nearly 3 years between previous $500 milestones.

🔥 WHAT DROVE THE RALLY

2025’s rally wasn't speculation. This was a fundamental repricing of gold's role in the global financial system. Here's what happened:

Central banks kept buying. 2025 marked the fourth consecutive year of 1,000+ tonnes in purchases. China, India, Turkey, and others continued diversifying away from US Treasuries.

The dollar weakened. The DXY dropped 10% as trade war uncertainty and fiscal concerns eroded confidence in US assets.

ETF flows exploded. Gold-backed ETFs saw $67 billion in inflows - the highest since 2020. Silver ETFs hit record holdings.

Tariff chaos created safe-haven demand. Uncertainty around trade policies sent investors scrambling for protection.

The Fed pivoted. Rate cuts made non-yielding assets like gold and silver more attractive relative to bonds.

Silver got squeezed. London vaults saw their lowest inventory levels in years. Industrial demand from solar, EVs, and AI kept pressure on supply.

🔮 LOOKING AHEAD TO 2026

The big banks are getting bolder with their forecasts:

J.P. Morgan: $5,000 gold by Q4 2026, $5,400 by end of 2027

Morgan Stanley: $4,500+ by mid-2026

Bank of America: Silver to $65 (already there)

The World Gold Council's 2026 outlook notes that the fundamental drivers - geopolitical uncertainty, de-dollarization, central bank buying - show no signs of reversing. If anything, they're accelerating.

But here's what I keep reminding myself: even the best bull markets have corrections. That's healthy. The trend remains intact, but expect volatility in 2026. That's where having a plan - and a community - matters.

✨ A QUICK NOTE ON GOLDBUZZ

When I hit "send" on our first edition in late August, I had no idea what to expect. Four months later, we're growing faster than I’d ever imagined, and your feedback has been phenomenal.

Thank you. Seriously. Every time you open an email, click a link, reply with feedback, or share us with a friend - it matters. You're helping build something special here.

2026 is going to be big. I'm working on some exciting additions - including a brand new price checking and charting website, with up-to-the-minute gold and silver news.

In response to many requests, I’ll also be making the Theseus research available in a daily, actionable form for those who want trading and investing guidance. And finally, I’ll be providing a 2026 buyers guide, to make it easy for you to find the best local resources for buying gold and silver. Stay tuned.

Holiday Break 🎄

This is our final edition of 2025. GoldBuzz will return on Sunday, January 4th, 2026.

Enjoy the holidays. Hug your family. Check your portfolio if you must - but don't stress about it. The bull market will still be here when we get back.

Before you go, please take a moment to rate GoldBuzz and tell us how we did this year.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Here’s to being early, staying informed, and navigating this historic market together.

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com