Welcome back, GoldBuzzers.

Well, that was a week. To our new subscribers, you picked a hell of a week to join.

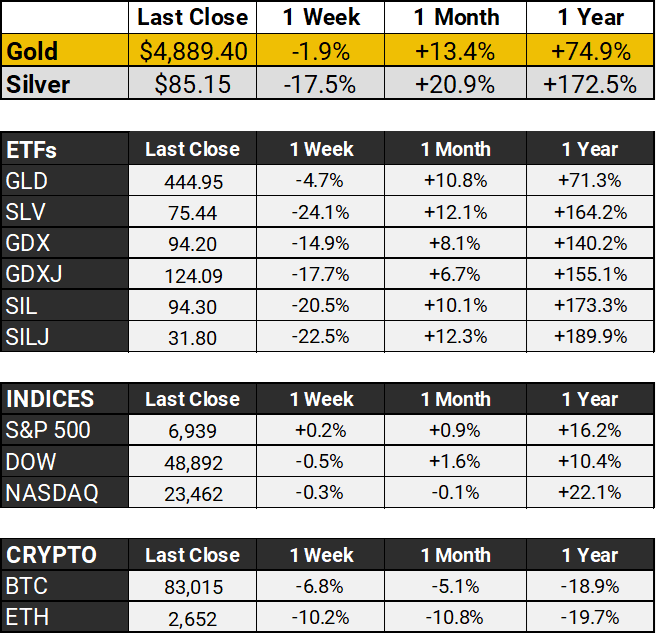

If you've been around a while, you know I don't sugarcoat things. Friday was brutal - but it doesn’t change as much as you might fear. And if you can believe it, Gold and Silver still ended the month with double digit gains.

Today, I’m going to break down what actually happened.

Let’s get into it.

Today’s Vibe 😂

The Scoreboard 🏆

After gold hit an all-time high of $5,608 on Thursday, Friday saw the largest single-day drop in decades - which I'll break down in a moment.

The fundamental cocktail that got us here hasn't changed a bit: the dollar keeps sliding (Trump seems fine with it), Iran is rattling sabres in the Strait of Hormuz, and the Fed just held rates while admitting they have no idea where inflation is headed.

We also got our answer on the Fed chair sweepstakes - Kevin Warsh is Trump's pick, which means someone who's been critical of loose monetary policy is likely running the show. Expect more volatility. But the underlying bid for hard assets isn't going anywhere.

If you've been waiting for a pullback to add, you just got one.

Deep Dive 🔍

Friday's Crash Was No Accident

We need to talk about Friday.

Gold plunged over 11% - nearly $600 - before recovering to $4,889. Silver got absolutely crushed, dropping 40% from a high near $122 to a low of $73 before recovering to $85. Together with other market losses, that's roughly $9 trillion in market value gone in hours.

So what happened? (This one runs a little longer than usual - stick with me.)

First, You Need to Understand How the Silver Market Actually Works

Silver has been suppressed for decades. The mechanism is simple: banks sell silver they don't own through the derivatives market, creating artificial supply that pushes prices down.

There are still influential figures in the gold and silver community who deny this, but it’s not a theory, it's settled law. JPMorgan paid $920 million in 2020 - the largest CFTC penalty ever - for running what the DOJ called an eight-year "scheme to defraud" in precious metals futures, and two of their traders went to federal prison in 2023.

Scotiabank paid $127.5 million for the same playbook. Deutsche Bank's $38 million settlement included handing over 350,000 documents and 75 audio recordings that implicated UBS, HSBC, and Barclays in coordinated silver rigging. In total, eight banks have paid over $1.3 billion in fines for precious metals manipulation. The physical market eventually wins - but the paper market can do a lot of damage along the way.

Millions of investors think they own silver through "unallocated" accounts - essentially contractual IOUs that promise an ounce of metal. The catch? Estimates suggest there are 300 to 400 paper claims for every physical ounce available to back them.

This house of cards stands as long as nobody actually demands the metal.

Enter China, now consistently paying at least $10-$20 per ounce above Western spot prices! That gap creates an irresistible arbitrage: buy paper claims in New York, demand physical delivery, ship the bars to Shanghai, pocket the difference. As long as that premium holds, the pressure on Western vaults is relentless - and at some point, somebody can't deliver.

The Shorts Were Staring at a $50 Billion Hole

On Thursday evening, COMEX showed 156,000 open silver contracts. At 5,000 ounces per contract, that's 780 million ounces - roughly a full year of global mine supply held in paper short positions.

The math gets ugly very fast. Every $10 rise in silver costs the shorts another $7.8 billion. Silver didn't rise $10 over the past couple of years. It rose almost $100. We're talking potential losses north of $70 billion.

Now here's the critical timing: American banks report their balance sheet positions to the Federal Reserve at the end of every month, and Friday was the last trading day for January.

Those losses needed to disappear before the reporting deadline. And they did - silver went from flirting with $122 to a low of $73 in a matter of hours. That's a 40% haircut that conveniently erased tens of billions in unrealized losses right before the books closed.

How They Did It

Mainstream media pinned Friday's crash on Trump's nomination of Kevin Warsh as Fed Chair. Warsh is hawkish on inflation, which boosted the dollar and triggered a risk-off move.

That's part of it. But it doesn't explain the violence of the move - or the timing.

COMEX silver futures volume spiked to 365,000 contracts, yet open interest only dropped by 8,055. For a 40% crash, that's nothing - it points to targeted short-covering, not genuine liquidation.

Only 531 tonnes of silver contracts traded in Shanghai, with no major physical withdrawals. This was a paper-driven shakeout, not a demand collapse.

Then there's the CME's margin hikes - up to fivefold in some cases - which forced liquidations right when shorts needed cover. JPMorgan issued all 633 delivery notices for February contracts at the crash's exact bottom, then prices rebounded. Make of that what you will.

The Physical Market Didn't Blink

No vaults were drained. Asian premiums held firm. Physical buyers absorbed the dip while paper traders panicked. Derivative markets can create chaos, but they can't create metal.

As long as silver in Shanghai trades at a significant premium to Western prices, the arbitrage pressure isn't going away. The structural problem remains: too many paper claims, not nearly enough metal.

We've Seen This Happen Before

In 2008, right in the middle of gold's decade-long bull run, the metal crashed 34% - from $1,033 to $681 - as the financial crisis triggered forced liquidations across everything. Headlines declared gold's safe haven status was dead.

Three years later, gold hit $1,900. Those who panic-sold locked in losses and missed out on the bull market. Those who held nearly tripled their money.

Same thing in 1976: gold crashed 47% mid-bull-market. What followed? A 440% rally over the next three years.

Friday's crash fits the pattern: forced liquidations, margin calls, paper chaos - while physical demand holds firm.

What Now?

Since Silver broke out of its 11-year base in the Spring of 2024, it has risen from around $24 to $120 (a 400% gain) in less than 24 months. Based on historical precedent, a correction into the $70-$80 zone was always realistic, possibly even lower toward $67.

Necessary price consolidations which often take months, were just compressed into a single trading day.

It's possible Friday marked the bottom. More likely, we chop around these levels for a while before the next leg higher. But the bulk of the damage? That might already be done.

The fundamentals are intact. Central bank buying, dedollarization, exploding industrial demand for solar and EVs, massive Chinese accumulation - are all still in play. And now, an important part of the leverage is flushed.

When the next leg up does begin, I also expect to see the miners really start to run.

The Takeaway

Friday was ugly. But the people who own physical metals, or metals in allocated storage, still own their metals. The people caught in leveraged paper positions? Many sadly got wiped out.

This bull market isn't over. Stack accordingly.

I use BullionVault for a chunk of my holdings. It’s allocated in my name, audited daily and I can choose the vault. That matters after a week like this.

That’s all for this Sunday, folks! I’ll see you on Tuesday.

Before you go, please take a moment to rate today’s GoldBuzz and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com