Happy Sunday, GoldBuzzers!

With so much to include in the newsletter today, and with an eye on keeping things a little shorter, let’s dive straight in!

Today’s Vibe 😂

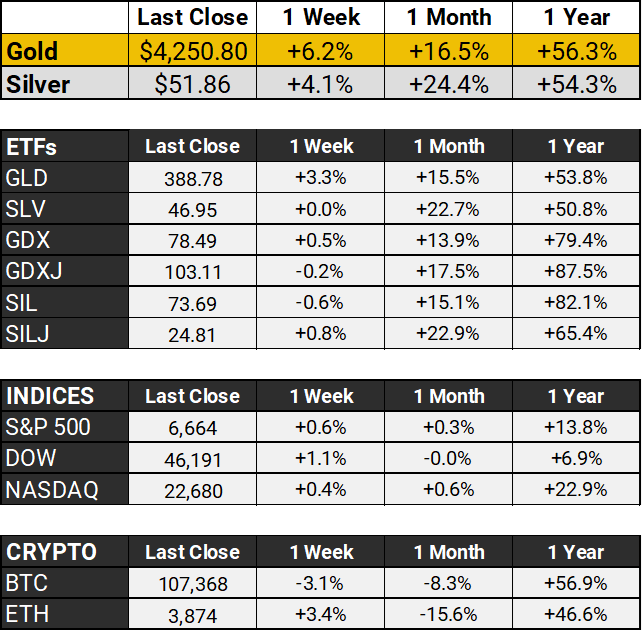

The Scoreboard 🏆

Gold Hits Record $4,392 Before Retreating on Trump Tariff Thaw

Gold retreated over 2% on Friday to around $4,250 per ounce, pulling back from an intraday record high of $4,392 as trade tensions eased. President Trump confirmed he'll meet with Chinese President Xi Jinping in two weeks and called his threatened 100% tariff "not sustainable," signaling possible de-escalation.

Gold futures have surged 63% this year, fueled by expectations of Fed rate cuts - with markets pricing in a 97% probability of a 25-basis-point cut at the October 28-29 FOMC meeting.

Gold ETFs recorded their strongest quarter on record in Q3, with global inflows totaling a whopping $26 billion, while central bank purchases have exceeded 1,000 metric tons annually since 2022, keeping Gold and Silver’s momentum firmly intact despite Friday's profit-taking.

Deep Dive 🔍

Gold's Record Rally is the Sound of Trust Dying

Gold's historic rally is about much more than supply and demand. It’s announcing that institutional trust is collapsing.

Why? Because the world is losing faith in the systems that were supposed to hold everything together. Central banks are dumping dollars. Investors are fleeing to a 5,000-year-old metal instead of something new. Trust has eroded so completely that tangible assets are crushing everything else.

The Numbers of Broken Trust

Look back at recent history. After Bernie Madoff's fraud collapsed in 2008, investors pulled $430 billion out of their investment portfolios.

The interesting part is that $430 billion is 25 times the actual wealth lost in the fraud itself. The trust shock created a cascade 25 times larger than the direct damage. And four years later, those withdrawals still hadn't reversed.

Right now, I believe we're watching a global version of that same dynamic. As an example, the share of people worldwide who believe "most people can be trusted" has fallen roughly 20% over the last 15 years. That's not a margin of error. That's a major shift in how humans relate to institutions, governments, and each other.

When Central Banks Lose Faith

The thing about institutional trust collapse is that you can actually measure it.

According to recent surveys, 95% of central banks expect to increase their gold holdings over the next 12 months. Meanwhile, 73% plan to reduce their dollar reserves. These are the people who run monetary systems. And they're voting with actual reserves, not press releases. Global central banks added 1,037 tonnes of gold in 2024 alone.

Central banks have increased gold purchases roughly fivefold since 2022, when Russia's foreign-currency reserves were frozen following its invasion of Ukraine. That freeze sent a signal heard around the world: your reserves aren't really yours when someone else controls the ledger.

China's central bank has added gold for 11 straight months. Asia now accounts for over half of global gold demand. The gold market's center of gravity has shifted from West to East. Many people missed it because they were busy watching crypto and AI stocks.

The Historical Pattern

In 1971, Nixon announced the end of the gold standard. The dollar index proceeded to have its worst year on record. Until now! The 2025 dollar index has dropped 10%, matching that historic decline.

The pattern repeats because the mechanism is simple. Institutions fail to protect people from crisis. Trust evaporates. People flee to things that don't require institutional backing.

And at the same time, we’re seeing these same institutions trying to centralize even more power and control for themselves, through proposed Digital ID systems and currencies.

Gold and Silver’s performance reflects something much deeper than inflation hedging or safe haven demand. It’s a global loss of confidence in the institutions, currencies, and frameworks that have defined the post-war financial order.

Trust takes decades to build. And right now, it's evaporating in real-time. You can measure it in gold prices hitting record highs while everything else feels increasingly fragile.

Nuggets 💰

A handful of stories you might have missed this week:

Gold smashed through $4,300 this week while silver rocketed past $54, as traders pile into safe havens amid the ongoing US government shutdown and renewed trade war jitters. INN

JPMorgan dropped a bombshell prediction that gold could hit $6,000 per ounce if just half a percent of foreign-held US assets gets rotated into the yellow metal. Yahoo Finance

Central banks are on an absolute buying spree, on track to purchase 2,700 tonnes of gold since 2022 – the fastest pace in recent history. Discovery Alert

A Florida treasure hunter diving in just seven feet of water off Sebastian discovered over $1 million worth of gold and silver coins from a 1715 Spanish shipwreck. CBS12

Your Take 🤔

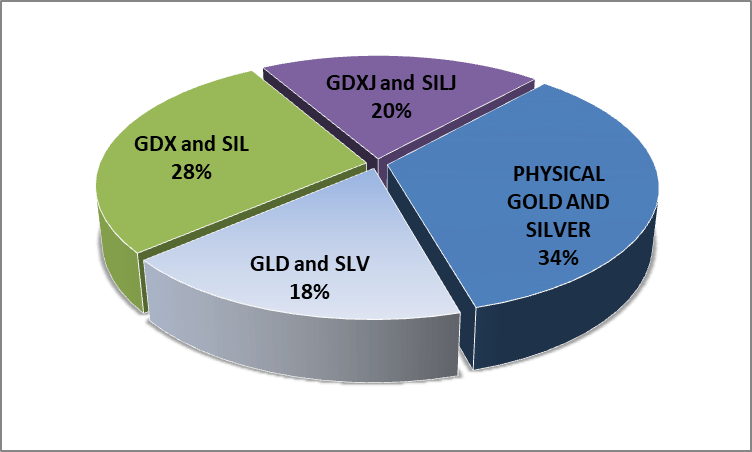

Last Sunday, I asked what you’d buy if you were investing next week, and it looks like you wanted to buy everything! Physical Gold and Silver was the clear winner, ahead of the ETFs, with GDX and SIL more popular than the others. I’ll have another poll for you next week.

Reader Poll: If you invested in Gold and Silver next week, what would you buy?

That’s all for this Sunday, folks. Enjoy the rest of your weekend.

Before you go, please take a moment to rate today’s GoldBuzz and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com