Happy Tuesday, GoldBuzzers!

Markets took a long weekend for Presidents Day, giving us all a rare moment to breathe after Silver's January rollercoaster.

In today’s Take Action Tuesday, I've got your quick-hit market recap, but the main event is something I've been wanting to talk about for a while: the actual numbers behind what it costs to stay invested in these markets.

It's more than most people think, and definitely more than most people want to talk about.

Let’s get into it. ⬇️

The Scoreboard 🏆

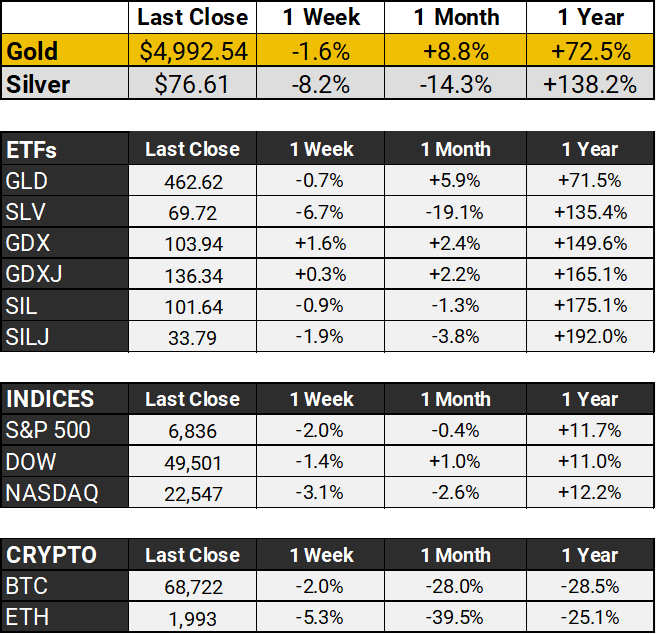

With Wall Street taking the day off to honor the presidents, precious metals traders were left to their own devices in thin holiday markets - and they used the opportunity to lock in some profits.

Gold slipped about 1% to just under $5,000, giving back some of Friday's 2.5% pop that came after softer-than-expected CPI data had everyone feeling rate-cutty again. Silver had a rougher session, sliding just under 2% to around $76 - but let's be honest, after the white metal's wild ride from a record $121 in late January to sub-$65 in early February and now back above $75, a quiet holiday session is practically therapeutic.

Markets are pricing in roughly 60 basis points of Fed easing by year-end, and all eyes are on this week's FOMC minutes and PCE data for hints on timing. Meanwhile, geopolitical wildcards remain in play with US-Iran nuclear talks and Ukraine negotiations both resuming Tuesday - either of which could send safe-haven demand in either direction.

China's Lunar New Year closure kept things even quieter than usual, though Chinese traders have been the main drivers of recent precious metals volatility. The bigger picture? Silver's still up 138% in a year, and gold is still consolidating around $5,000.

Take Action Tuesday 📅

How Much Pain Can You Actually Handle?

On Sunday I talked about my own journey from emotional investing to a much more structured approach. Today I want to get practical. Before you buy a single ounce of gold, a share of a mining ETF, or a fraction of a Bitcoin, you need to answer one question honestly with yourself: how much pain can you actually handle?

Not theoretically. Actually.

The numbers nobody likes to discuss

We talk a lot about gold’s incredible run past $5,000. We talk about silver’s explosive potential. We talk about Bitcoin’s life-changing gains. What we don’t talk about enough is what it costs to stay on the ride.

One of the first things that jumped out at me when I started the Theseus research was how savage the drawdowns are in all of these markets. A drawdown is the largest drop from a high point to a subsequent low - the worst pain an investor experiences before prices recover.

Here’s what buy-and-hold investors actually earned, and what they had to sit through to get it:

Market | Annual Return | Worst Drawdown |

Gold | 11.8% | -45% |

Silver | 11.6% | -75% |

Bitcoin | 26.4% | -81% |

Gold Miners | 4.7% | -81% |

Silver Miners | 8.9% | -65% |

Gold and Silver data (2001-2025). ETFs used as a proxy for gold and silver miners

Look at gold miners. An 81% drawdown - the same as Bitcoin - but for a 4.7% annual return. Bitcoin at least paid you well for the ride. Gold miners barely kept pace with inflation. Risk Tolerance isn’t just about how much pain you can take. It’s about whether the return is worth it.

The recovery problem

What makes large drawdowns so dangerous is the maths of getting back to even:

Loss | Gain Needed to Recover |

-25% | +33% |

-50% | +100% |

-75% | +300% |

-81% | +426% |

Silver’s 75% drawdown means you need silver to quadruple just to break even. Gold miners’ 81% drawdown means prices need to more than quintuple. How many years are you willing to wait for that?

Two types of investor

During the Theseus research, and more recently as I’ve been preparing to launch something new for GoldBuzz readers, I’ve spent a lot of time studying how different approaches to the same markets can produce very different outcomes.

What I found is that investors broadly fall into two camps, and neither is wrong.

This wasn’t something I just noticed in the data. Over the past year, I’ve been sharing trading signals with a small group of beta testers, and the same split showed up almost immediately. Some wanted to be in the market as much as possible - they’d rather ride out a bad trade than risk missing a good one. Others wanted to know they were only exposed when conditions were strongly in their favour, even if it meant sitting in cash for months at a time. Same signals, same markets, completely different priorities.

The first camp wants maximum exposure. They want to catch every rally. They’re comfortable with volatility, willing to accept bigger drawdowns, and their biggest fear is missing the move. If gold is running, they want to be in it. Period.

The second camp prioritises capital preservation. They’d rather miss some upside than live through a 75% decline. They’re comfortable sitting in cash for extended periods, knowing their money is safe, and they only want to be invested when conditions strongly favour it. Their biggest fear isn’t missing out - it’s losing what they have.

One of the striking findings of all this research was that you don’t necessarily have to sacrifice returns to reduce risk. In many of the markets I studied, being more selective - spending real time in cash - actually produced comparable or better returns per day invested. Your capital works harder when it’s only in the market during the right conditions, and the rest of the time it’s not at risk at all.

Your action item this week

Over the next couple of weeks I’ll be sharing more specific findings from my research - how different approaches to these same markets have produced very different results, not just in returns, but in the size of the losses along the way, and I think you’ll find that helpful in guiding your own personal trading style.

So, before you make your next precious metals purchase, be honest with yourself about which camp you’re in. Ask yourself: if my gold position dropped 25% over the next three months, would I buy more, hold steady, or sell? If my silver miners lost half their value, could I hold on for the recovery? There’s no right answer - but there is an honest one, and it should shape every investment decision you make.

📦 Recommended Resources

Services I use and recommend

🇺🇸 Gold IRA - Augusta Precious Metals ⭐ read my review

Allocated Storage - BullionVault

🇨🇦 🇺🇸 Physical Delivery - Silver Gold Bull, Sprott Money

That’s all for this Tuesday, folks. See you on Thursday.

Before you go, please take a moment to rate today’s newsletter and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com