Good morning GoldBuzzers, and a very happy Tuesday to you!

Since I started featuring the ETFs in The Scoreboard, it’s been plain to see that GDXJ has been the top performer over the past 12 months. It’s outperformed not just gold and silver themselves, but also the other gold/silver ETFs, the stock market AND Bitcoin too.

The leverage junior miners provide is no joke, and several of you have emailed to ask my thoughts about it, so in today’s Company Corner, I’ll be taking a deeper look.

Ok, let’s dive in.

The Scoreboard 🏆

Gold's holding the line at $4,000, folks. After a Monday spent trading sideways around the psychological $4K level, the yellow metal is playing defense while the dollar flexes its muscles at three-month highs. We're still a solid $380 below that glorious October peak of $4,382, but here's the deal: gold isn't rolling over - at least not just yet!

The Fed threw cold water on rate cut dreams last week when Jerome Powell delivered that quarter-point cut but basically told Wall Street "don't get too comfortable." With the government shutdown leaving us data-blind (no jobs report, no clarity), Powell made it clear December's cut is "far from a foregone conclusion." Markets got the memo - odds for a December move dropped from 100% to around 70%. That's your dollar rally right there!

Gold's caught between competing forces: a hawkish Fed and a strong dollar pressing down, but still-elevated geopolitical uncertainty is providing support. The $4,000 floor is holding for now, but we're watching that dollar strength and December Fed decision closely.

It wouldn’t surprise me at all if we have further to fall before we’re ready to fully resume the bull market.

Company Corner 🏢

Is GDXJ Your Golden Ticket?

While the mainstream coverage has been about Gold and Silver this year, with a sprinkling of headlines about the big boys like Newmont, this sneaky little ETF has outperformed them all in 2025.

Meet GDXJ – the VanEck Junior Gold Miners ETF, and despite the mid-October smackdown, it’s still up a jaw-dropping 115% year-to-date.

I probably shouldn’t say “little” as it’s now holding $8.4 Billion in net assets!

GDXJ is a basket of about 90 small to mid-cap gold and silver mining companies - the hungry upstarts, not the boring blue chips. These are the firms that actually dig the stuff out of the ground, not just sit on piles of bullion. Here are the current top holdings:

GDXJ Top 10 Holdings

Pan American Silver is narrowly the largest holding, but since that’s still only 6.75% of the fund, you’re not heavily weighted in any one company. Instead, you’re getting instant diversification across about 90 mining operations without having to pick winners and losers.

The net expense ratio is 0.51%, so you’re essentially paying a half a percent professional management fee in return for owning a basket of 90 stocks in a highly liquid fund.

The Core Requirements:

To be included in GDXJ, companies must generate at least 50% of their revenues from gold and/or silver mining, royalties, or streaming

OR have mining projects with the potential to generate at least 50% of their revenues from gold/silver when developed

The "Junior" Definition: This is the interesting part - "junior" doesn't just mean small. GDXJ specifically targets companies that rank between the bottom 60% and 98% of mining companies by market cap.

So they're essentially capturing the middle tier - not the tiny speculative plays that could go to zero tomorrow, but not the mining giants either. As of the latest data, that translates to companies with market caps ranging from $129 million up to $7.75 billion.

What This Means:

They exclude the biggest miners (top 40% by market cap) - those go in GDX, the senior miners ETF

They also exclude the tiniest, riskiest micro-caps (bottom 2%)

It's a passive index, so stocks are selected mechanically based on these rules, not by some manager's hunches

This "goldilocks zone" approach gives you exposure to companies that are established enough to actually be producing or near production, but still small enough to have serious growth potential when gold prices rise. They're hungry and nimble, but not betting the farm on a single exploratory hole in the ground.

That's why GDXJ can deliver that leverage to gold prices without the extreme risk of picking individual junior miners yourself.

The thing about junior mining stocks is that they don't track gold prices - they amplify them.

When gold moves up 10%, a junior miner's profit margin might expand 30% or 40%. Why? Operational leverage. Mining companies have mostly fixed costs. Equipment, labor, permitting costs stay relatively stable whether gold trades at $2,000 or $4,000 per ounce.

Revenue moves with gold prices.

So when gold climbs, every extra dollar goes straight to profit. In Q2 2025, mid-tier miners averaged $1,367 all-in sustaining costs against a $3,285 gold price. That created $1,918 per ounce in profit.

Historical Patterns Show Massive Upside

The leverage ratios from previous cycles tell the story. During 2020's gold rally, a 40% increase in gold prices generated a 188.9% gain in GDXJ. That's 4.7x leverage.

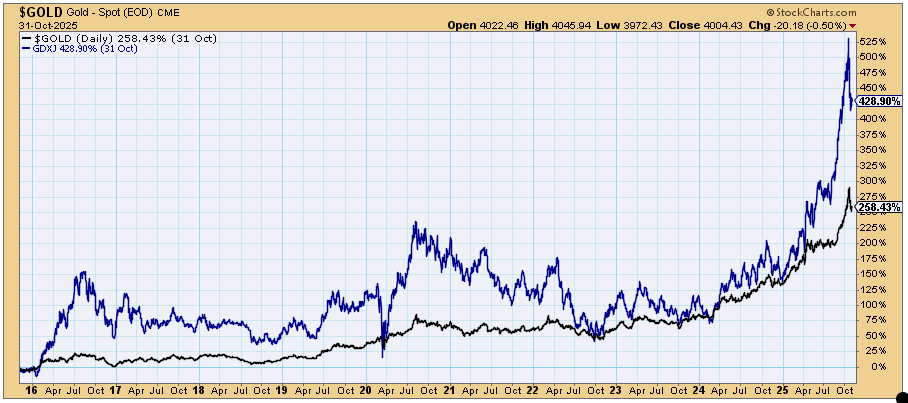

Here’s a chart showing Gold’s percentage profit (black line) versus GDXJ (blue line) over the past decade. You can see how GDXJ has been significantly more volatile, as well as more profitable.

Gold (black) vs GDXJ (blue) Percentage Gain

Why Not Just Buy Individual Miners?

Of course, picking that one junior miner that goes up 10x or even 100x is the dream. But here's the reality check: for every winner, there are five companies that'll drill dry holes, get tangled in permitting nightmares, or have their CEO run off to Tahiti with the treasury.

GDXJ spreads your risk across the entire sector. When gold's rising, the whole basket benefits. You get the upside of the sector without the heartburn of watching your single pick crater because they found arsenic instead of gold.

The Bottom Line

Is GDXJ volatile? Absolutely. Could it drop 20% next month? Sure it could. It just dipped 15% from the October peak.

But with central banks printing money like it's going out of style, and as long as you’re prepared to hold for a while, then GDXJ offers turbocharged exposure to the trend.

Just remember: this isn't your safe-haven play. This is your "I think gold's going higher and I want leverage" play. Size your position accordingly - this shouldn't be your entire retirement fund, but it might well deserve consideration in your portfolio.

That’s a Tuesday wrap, folks. Take care of yourselves and I’ll see you on Thursday.

Before you go, please take a moment to rate today’s newsletter and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com