Happy Sunday, GoldBuzzers!

Another steady week for Gold as it tries to decide what it wants to do next.

Meanwhile, it’s been a historically bad week (and month) for crypto, and in today’s Deep Dive, I’ll be examining why Bitcoin's "digital gold" crown is slipping after a brutal 40% plunge against the real deal.

Ok, let’s dive in.

Today’s Vibe 😂

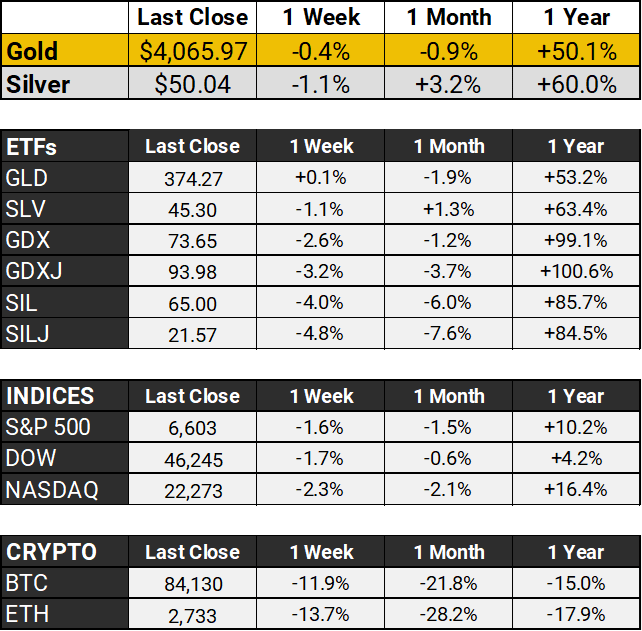

The Scoreboard 🏆

Gold wrapped up the week hovering around $4,065 per ounce, trimming earlier losses but still on track for its first weekly decline in three weeks as the yellow metal got caught in a tug-of-war between dovish Fed whispers and surprisingly resilient (but still murky) labor data.

The delayed September jobs report finally dropped Thursday, showing 119K new jobs versus the expected 50K, though unemployment still ticked up to 4.4% - classic mixed signals that had traders reaching for the Advil.

Fed minutes revealed a committee more divided than a Thanksgiving dinner table, with "strongly differing views" about December's rate decision, though NY Fed President John Williams swooped in Friday suggesting "near-term" cuts toward neutral are still on the menu, sending the 10-year yield tumbling below 4.1% and giving gold its groove back.

With CME FedWatch odds for a December cut jumping to 75% from under 40%, and central banks still hoovering up 900 tonnes this year while Chinese ETFs surged 70%, so while prices are enjoying a well-overdue rest, the fundamentals are stronger than ever.

Deep Dive 🔍

Is the 'Digital Gold' Myth Shattered as Bitcoin Crumbles 40% Against Gold?

Gold and Crypto. I sometimes think of them as two sides of the same coin - the old and the new - both hedges against inflation and government excess. Many gold holders, hold some crypto too and I have friends, whose views I hold in high regard, who have owned Bitcoin for years.

I'll admit it - when Bitcoin first hit the scene, I was genuinely excited. Here was this revolutionary digital currency that promised to break the dollar's stranglehold, give regular folks monetary freedom, and actually work as money for buying coffee or paying rent.

Fast forward to today, and what do we have? In some ways, it’s become a casino chip for hedge funds and a speculative toy that swings 20% on Elon's tweets. Nobody's buying groceries with Bitcoin - they're hoarding it hoping to flip it to the next guy for more fiat.

The dream of peer-to-peer electronic cash died somewhere between the Lamborghini memes and institutional adoption, leaving us with just another asset that trades against the very dollars it was supposed to replace. And before the crypto bros come at me, remember: I'm not anti-innovation, I'm pro-reality. Gold has been money for 5,000 years - Bitcoin's had 15 years to prove itself as currency and I don’t believe it’s done that yet.

Bitcoin’s Origins

Speculation persists that Bitcoin was created by the CIA. But why would the CIA create a currency that undermines dollar dominance? The transparent blockchain is terrible for covert ops - privacy coins like Monero would make way more sense. Plus, Bitcoin's decentralized nature runs completely counter to government control objectives.

My take? If it was a government project, it backfired spectacularly. They created a monster they can't control, which is exactly what the cypherpunks who actually built the groundwork for Bitcoin wanted all along. Either way, as one commentator noted - even if the CIA created it, "Satoshi is not Bitcoin" anymore. That ship sailed years ago.

While crypto bros like Michael Saylor, have been predicting Bitcoin's moon mission to $250,000, gold quietly crushed it this year. The divergence wasn't just dramatic. It was historically unprecedented.

Bitcoin crashed below $90,000 in November, erasing every gain it made in 2025. Just six weeks earlier, it peaked at $126,250. That's a 28-30% nosedive that pushed sentiment into extreme fear territory, triggering a technical "death cross" pattern that historically signals prolonged downtrends.

Gold? Different story entirely. Different universe, actually.

The Shiny Numbers Tell a Brutal Story

Gold surged 56% in 2025, smashing through record $4,000 per ounce and becoming the year's top-performing major asset. Not just beating Bitcoin. Beating stocks, bonds, real estate, and pretty much everything else investors threw money at.

But here's where the story gets really interesting - and really uncomfortable for Bitcoin maximalists.

When you price Bitcoin in gold terms instead of dollars, it's down roughly 40-43% this year. The BTC-to-gold ratio dropped from 40 ounces last December to just 31.2 ounces in some measurements, with technical analysts charting drops as low as 22 ounces during the worst selloffs.

That's not just a bad quarter. That's Bitcoin's weakest performance against gold ever recorded in its entire 16-year history.

Let me put that in perspective. During Bitcoin's supposed "maturation" as an asset class - after institutional adoption, ETF approvals, and corporate treasury allocations - it lost nearly half its value against the very asset it was designed to replace.

Peter Schiff, the long-time Bitcoin critic and gold advocate, called it a fraud. His exact words: "Bitcoin's collapse relative to gold exposes the digital-gold hype as a fraud." Strong language. But when you're staring at a 40% performance gap, the charts don't lie.

Technical analyst Aksel Kibar pointed out that Bitcoin priced in gold has returned to 2021 levels, breaking a multi-year uptrend. That's three years of supposed progress - gone.

What's Actually Driving This Divergence

The "digital gold" narrative was Bitcoin's strongest value proposition. A store of value. An inflation hedge. A safe haven asset. The whole pitch rested on Bitcoin behaving like gold 2.0 - all the benefits of precious metals, none of the storage costs or physical limitations.

2025 has certainly damaged that narrative.

When real macroeconomic pressure hit - rising bond yields, currency debasement concerns, mounting sovereign debt - investors didn't reach for Bitcoin. They fled to what's worked for literally thousands of years. Physical gold.

And they weren't retail investors panic-selling. Central banks became the biggest gold buyers on record, with institutions piling in as geopolitical tensions escalated. Ray Dalio recommended 15% portfolio allocations to gold. Goldman Sachs raised their December 2026 forecast to $4,900 per ounce.

Bitcoin? It behaved exactly like a speculative tech stock during a correction. High volatility, sentiment-driven selloffs, correlation with risk assets. Everything gold is not.

The Real Test Bitcoin Failed

Bitcoin had its moment to prove the digital gold thesis, and it has so far failed the test.

The setup was perfect. Inflation concerns. Geopolitical instability. Debt-to-GDP ratios hitting historic levels. Currency debasement across major economies. This was Bitcoin's championship game - the exact conditions where a true safe haven asset should outperform.

Instead, Bitcoin got crushed while gold soared.

The correlation patterns tell the real story. Bitcoin's 30-day correlation with the S&P 500 remained stubbornly high throughout 2025, hovering around 0.6-0.7 during key volatility spikes. Gold's correlation? Near zero or negative. That's what an actual uncorrelated safe haven looks like.

What This Means for Bitcoin's Future

So where does this leave Bitcoin?

The digital gold narrative is severely wounded. If Bitcoin isn't digital gold, maybe it's something else entirely. A speculative growth asset. A technology play on blockchain adoption. A hedge against specific types of monetary policy rather than a broad safe haven. But it's clearly not the inflation-resistant, volatility-dampening store of value that gold has proven to be.

The performance gap also raises uncomfortable questions about institutional adoption. Bitcoin ETFs launched with massive fanfare, corporate treasuries allocated billions, and mainstream financial institutions blessed it as a legitimate asset class. Yet when stress-tested by real market conditions, Bitcoin still traded like a momentum play, not a mature store of value.

Meanwhile, gold's 56% surge wasn't driven by hype or retail FOMO. It was methodical institutional buying based on centuries of historical precedent. That's the difference between a proven safe haven and an aspirational one.

The Bottom Line

Gold didn't just outperform Bitcoin in 2025. It exposed a fundamental flaw in the digital gold thesis that Bitcoin advocates spent years constructing.

When markets got choppy and uncertainty spiked, money flowed to the yellow metal, not the orange coin. That's a verdict on what investors actually trust when everything else is falling apart.

Bitcoin's 40% collapse against gold represents the largest divergence between these assets since Bitcoin's creation.

Whether this trend continues or reverses, one thing became crystal clear this year: In a real flight to safety, traditional stores of value still dominate. And if Bitcoin wants to compete in that arena, it needs to fundamentally change how it behaves under pressure.

Until then, the "digital gold" label looks less like innovation and more like marketing.

Nuggets 💰

A handful of stories you might have missed this week:

China just dropped the mother of all gold discoveries. Euronews

Gold's crushing it as investors keep piling in despite the nosebleed prices. Fortune

Discovery Silver just flexed hard with Q3 results. Globe Newswire

Goliath Resources keeps hitting visible gold at Surebet. North of 60 Mining News

French dude strikes gold while digging a swimming pool. CBS News

Silver's structural deficit hits year five. Silver Institute

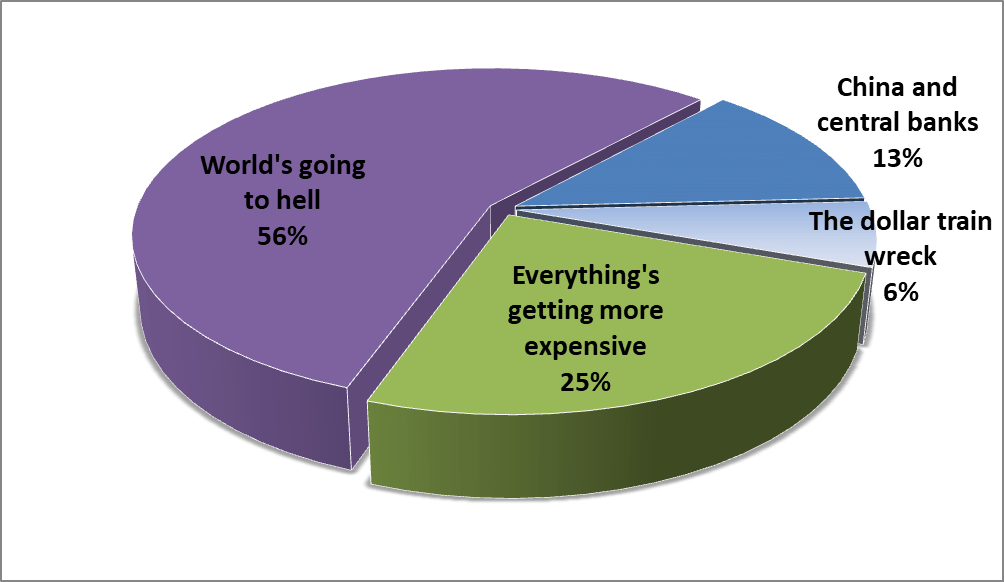

Your Take 🤔

Last week, I asked what was the main factor driving the gold price.

What’s the main factor driving the gold price?

Well there you have it - “the world’s going to hell” (wars, sanctions, chaos) came out top with a resounding 56% of your votes, followed by “everything’s getting more expensive” at 25%, China and central banks at 13% and only 6% of you gave credit to the dollar!

That’s all for this week, folks! Look after yourselves and I’ll see you on Tuesday for a quick update.

Before you go, please take a moment to rate today’s GoldBuzz and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com