Happy Sunday, GoldBuzzers!

The leaves are falling, coffee shops are selling pumpkin spice lattes, and it's Halloween on Friday.

But the only thing truly scary this week was watching gold and silver take a tumble - though as you'll see in today's Deep Dive, these scares are more treat than trick for patient investors.

Today, I’m going to be taking a quick look back through history, analyzing the anatomy of previous gold bull markets - what they look like, how they behave, and why the recent pullback is actually following a very familiar (and very profitable) script.

By the way, Thursday’s feature about the current panic in the gold markets generated a ton of positive emails, ratings and comments - more than ever before - keep them coming!

So grab your favorite fall beverage, settle in, and let's explore why seasoned gold investors have learned to love these corrections. After all, the best time to prepare for the next leg up is when everyone else is running scared.

Let’s dive in.

Today’s Vibe 😂

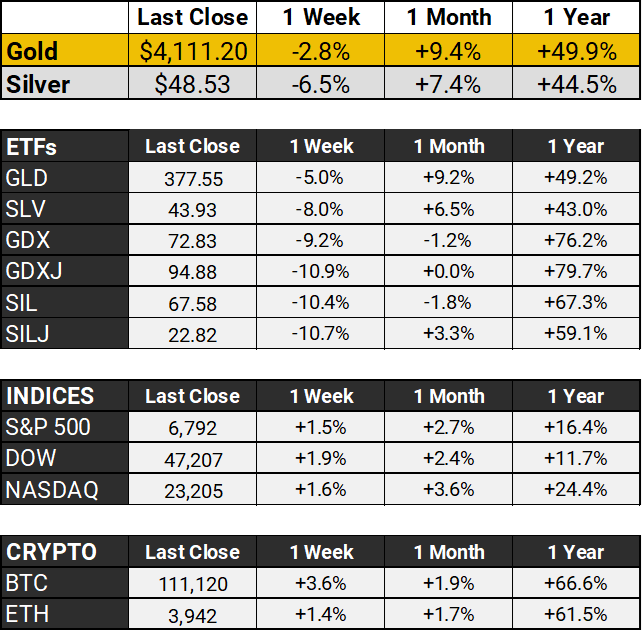

The Scoreboard 🏆

Gold Takes a Breather After Epic Nine-Week Run

After a bonkers nine-week winning streak that peaked at $4,380, gold finally caught its breath on Friday around $4,111 - still up 58% year-to-date but suffering its sharpest drop in five years as traders locked in profits.

Friday’s delayed CPI report threw gold a lifeline (inflation came in softer at 3.0% vs expected 3.1%), boosting Fed rate cut expectations, but the pullback continues as Trump slapped first-time sanctions on Russian oil giants Rosneft and Lukoil and markets await next Thursday's Trump-Xi summit in Malaysia.

Goldman Sachs remains bullish with a $4,900 target for end-2026, citing continued central bank buying - bottom line, gold's taking a well-deserved breather but the fundamentals (inflation, rate cuts, geopolitical drama) still scream "own some gold." This dip might last a while and be your entry ticket before the next leg up.

Deep Dive 🔍

The Anatomy of Gold Bull Markets

I get it. The recent pullback feels significant. It shakes confidence. After watching gold hit record highs through 2025, seeing it retreat suddenly makes you question the whole thesis.

But what does historical data actually show?

When Bulls Correct Hard

The 1970s gold bull market remains the most studied precious metals cycle in modern history. From $35 to around $850, it delivered life-changing returns (highest daily close recorded at $834 on January 21st, 1980.)

The Great Gold Bull Market of the 1970s

What most people forget is what happened in the middle.

In December 1974, gold peaked at around $195. Over the next 1.7 years, it crashed 47.7% to roughly $103 by August 1976. Nearly half its value, gone. Investors who sold during that collapse missed the subsequent move to $850.

The decade still delivered 2,155% gains overall.

Think about that pattern. A 47% correction didn't invalidate the bull market. It was a feature of it, not a bug.

The 2000-2011 cycle told a similar story. Gold rose 659% over that period, but the path included multiple 20-30% pullbacks that felt catastrophic in real time. Each one triggered the same question we're hearing now. Is this time different?

Gold 2000 - 2012

What Makes This Cycle Different

We could say that the current bull market started in 2016. After an initial surge to $1,365 in the first half of that year, gold spent 4.5 years consolidating, unable to break through that ceiling until June 2019.

But in my view, it was March 2024 that changed everything. I was just completing the Theseus 4-year research project, when the software flagged a major breakout from an extensive basing period, which had lasted more than a decade.

Big, multi-year bases precede big, multi-year moves, and we're now in the second major leg of what historically becomes a multi-leg secular bull market.

Gold from 2016

For the fundamental backdrop, we know that central banks are buying at levels we've never seen. In 2024 alone, they purchased 1,045 tonnes of gold. That marks three consecutive years above 1,000 tonnes, compared to the 473 tonne annual average between 2010 and 2021 (See The Gold Awakening).

They're buying at more than double their historical rate.

When we see the institutions that print money start accumulating gold at unprecedented levels, that tells us something about their confidence in fiat currency. This isn't mere speculation. It's observable behavior from the world's most informed monetary actors.

The Second Half Pattern

History offers another clue about where this is headed.

Both previous gold bull decades showed a distinct pattern. The second half delivered the most explosive gains. In the 1970s, gold rose 162% in the back half of the decade. The 2000s saw a 150% increase in the final five years.

If the current cycle follows a similar trajectory, gold could easily reach around $6,800 by the end of this decade from its $2,624 midpoint.

That's not a prediction. It's a pattern observation, but there’s plenty of reasons to believe that to be a very conservative estimate.

The 1970s bull market actually peaked three weeks after the decade ended, with gold surging 63% in just those final weeks. The most dramatic moves happen in the final phase, not the middle.

We're roughly three years into what typically becomes a five to six year cycle from the October 2022 low. If the pattern holds, the majority of gains still lie ahead.

What The Correction Actually Means

Every significant gold bull market has included corrections that felt like endings. The 1974-1976 crash. The multiple 20-30% drops in the 2000s. Each one convinced investors the run was over.

Each one was wrong.

The current 7% pullback is actually very modest compared to historical norms. In 1974, gold and silver fell 45% while stocks dropped 70%, and that outperformance of Gold was a clue to what lay ahead.

The Greatest Risk

The greatest risk in gold bull markets isn't holding through corrections. It's exiting too early.

Investors who sold during the 1976 bottom missed the move from $103 to $850. Those who panicked during 2008's correction missed the final surge to $1,900 in 2011.

The pattern repeats because human psychology doesn't change. Fear feels rational in the moment. The data suggests otherwise.

Look at the current environment. We're combining 1940s-level government debt with 1970s-style inflation concerns and 1990s market speculation. Gold currently represents just under 3% of global financial assets, compared to 5% in 1968 and 10% in 1942.

There's room for significant reallocation.

Central banks clearly see this. Their survey data shows 95% expect global gold reserves to increase over the next twelve months. That's the highest conviction level ever recorded.

When institutional buyers show that kind of certainty, corrections become opportunities rather than exits.

Where We Stand

The current pullback fits the historical pattern of corrections within secular bulls. The 47.7% crash of 1974-1976 didn't stop the 1970s bull market. Multiple 20-30% drops didn't derail the 2000-2011 cycle.

This 7% correction is noise within a larger signal.

The fundamentals driving gold remain firmly intact. Central banks continue buying at historic rates. Debt levels keep climbing. Monetary policy remains accommodative despite inflation concerns. Technical indicators show the 2016 channel holding.

The current 7% dip in Gold barely registers as a correction, either in price or time, so it would be entirely normal to see this consolidation phase go deeper and last longer.

However, we're still in the early-to-middle phase of this bull cycle, with the most significant gains typically occurring in the final third.

The question isn't whether corrections happen. They always do.

The question is whether you understand them as features of bull markets rather than endings.

Nuggets 💰

A handful of stories you might have missed this week:

Gold Takes a Breather After Epic Run After hitting a jaw-dropping $4,380 per ounce on Monday, gold experienced its biggest single-day drop in over a decade on Tuesday, plunging 6.3% as traders cashed in on the metal's 45 new all-time highs this year. Mining.com

Platinum Surges 6.4% in Biggest Jump Since 2020 Spot platinum prices in London rocketed up 6.4% to $1,646 an ounce on Wednesday, sparking fears of another precious metals squeeze as the gap between spot and futures prices widened to $53 per ounce. Bloomberg

Silver's Wild Ride Continues Silver dropped more than 6% on Friday in its biggest decline in six months, though at $48-49 per ounce it's still up a whopping 44% year-over-year as precious metals retreated after their furious rally. Mining.com

Central Banks Now Hold More Gold Than U.S. Treasuries For the first time since 1996, foreign central banks' gold reserves have overtaken their U.S. Treasury holdings, with China playing a key role in this historic shift toward hard assets as institutions diversify away from dollar-denominated securities. Visual Capitalist

India's Festival Season Goes for Coins Over Jewelry Record gold prices led Indian buyers to choose coins and bars over jewelry during last weekend's Dhanteras festival, with jewelry demand dropping 30% while investment gold products flew off the shelves as buyers adapted to $25/oz premiums. Discovery Alert

China Drives Gold Rally According to Apollo Apollo's chief economist Torsten Slok says China is playing a key role in gold's surge through central bank buying, arbitrage trading, and increased speculative demand among Chinese households, with the data showing massive outflows from China. Fortune

ETF Investors Can't Get Enough Gold Gold ETFs are seeing their strongest inflows since 2020, with investors pouring in $67 billion year-to-date, though holdings remain 2% below their pandemic peak - suggesting there's still room to run. World Gold Council

That’s all for this Sunday, folks.

Before you go, please take a moment to rate today’s GoldBuzz and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com