Happy Thursday, GoldBuzzers - wild times in the markets, but gold keeps doing its thing!

Many of us are also keeping a close eye on crypto, and Bitcoin and Ethereum have now entered the red over the past year. Added to that, ever-fluctuating energy costs mean that bitcoin mining margins are getting crushed at these prices.

While crypto sentiment has turned bearish, we need to keep a close watch on what's brewing in the AI sector - a potential bubble that makes crypto volatility look tame by comparison. That's the focus of today's Real Talk, and trust me, this one's important.

Ok, let's dive in.

The Scoreboard 🏆

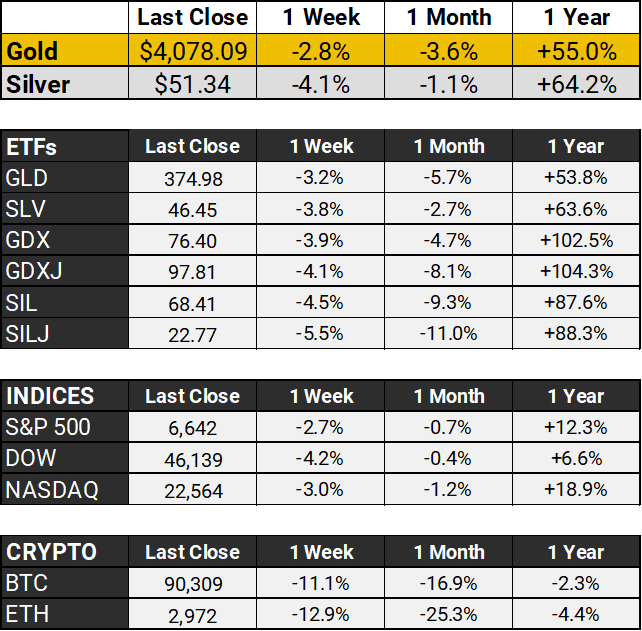

Gold climbed back above $4,070 on Wednesday as the Fed's October minutes revealed a more fractured committee than markets expected. While "most participants" still see further cuts likely, "many" officials suggested keeping rates unchanged for the rest of 2025, and "several" indicated a December cut isn't necessarily appropriate.

This surprisingly divided Fed put the kibosh on December cut expectations, with markets now pricing only about a 1 in 3 chance for a December move, down from near certainty just days ago. The yellow metal found itself sandwiched between a firmer dollar (typically bearish) and safe-haven demand from jittery tech investors who are suddenly questioning whether those AI billions will actually pay off anytime soon.

Adding to the fog, the October jobs report has been completely canceled due to the government shutdown's impact on data collection, while November's report is delayed until December 16 - meaning the Fed will be flying partially blind at their December 9-10 meeting.

It’s been a rough time for crypto bulls, with Bitcoin (down 11% in a week) temporarily dipping below $90k on Wednesday, and Ethereum having lost 25% in a month.

For Gold and Silver, until we get a clear catalyst from the Fed or fresh economic data, we're likely stuck in this trading range until something breaks the stalemate.

Real Talk 🎯

The Dirty Secret Behind AI's Trillion-Dollar Revenue Loop

The whirlwind of 2025's tech frenzy has positioned artificial intelligence (AI) as the primary engine driving America's economic resurgence. Yet with gold prices touching $4,100 per ounce this week, savvy investors are asking a crucial question: Is this AI-driven growth sustainable, or are we staring down the barrel of another dot-com-style collapse?

The House of Cards

Let's break down what's really happening. The U.S. economy has been on a tear, but 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending growth since ChatGPT launched in November 2022 have come from AI-related stocks. Those are stunning figures. It's like building a skyscraper on a narrow foundation - it looks impressive from afar, but it’s vulnerable to collapse.

The most damning evidence comes from what industry insiders call "circular revenue" - big tech firms like Microsoft, OpenAI, NVIDIA, Oracle, and others are essentially funding each other through investments, purchases, and deals - creating an illusion of growth as money bounces around the same ecosystem.

I referenced this a couple of weeks ago, when I wrote about the $57 trillion S&P valuation and one of the clearest summaries comes from a Bloomberg graphic that's been making the rounds on social media, visualizing these interconnections.

Gold's Evolution: From Safe Haven to Strategic Asset

This isn't just speculation anymore. The alarm bells are getting louder. Macro Liquidity analyst Sunil Reddy made a seismic observation.

This resonates because it points to gold's evolving role as the AI bubble continues to inflate. Unlike Treasuries, which could falter under mounting U.S. debt (now exceeding $38 trillion), gold offers scarcity and independence from government policies.

The Perfect Storm Brewing

Even mainstream analysts are now highlighting how AI-related stocks are trading at stretched valuations, with companies eager to tout their AI prowess despite suffering vast financial losses.

More than 1,300 AI startups now have valuations of over $100 million, with 498 AI “unicorns,” or companies with valuations of $1 billion or more.

OpenAI expected about $5 billion in operating losses on $3.7 billion in revenue last year, and is still losing money.

Why Gold Specifically? The AI Automation Factor

But why gold over other safe havens? Let’s look at the big picture.

In an increasingly AI-dominated world, automation could soon displace millions of jobs, fundamentally changing the nature of value itself.

Think of it this way - AI makes human labor increasingly worthless, but makes gold priceless. As automation deflates everything it touches, your gold stash keeps buying more productivity - and when governments panic about deflation and fire up the money printers, that’s when we’ll likely see $10,000 gold and beyond.

Also, don’t forget that today isn't like 2008 where QE could restart lending and boost corporate profits. When AI permanently destroys demand by killing jobs, printed money has nowhere productive to go - except into real assets like gold.

The Big Picture: Capital Flight to Gold

History backs this up. The current AI enthusiasm feels similar to the internet boom of the late 1990s, which correctly promised to change the world despite leaving many companies ultimately worthless.

Today, central banks are hoarding gold at a record pace, diversifying away from fiat currencies amid geopolitical tensions and debt worries

For everyday investors, this isn't about doom and gloom - it's about balance. While AI stocks dazzle with quick gains, they carry serious bubble risks. Gold, on the other hand, has climbed 56% this year alone, proving its mettle (pun-intended) as a non-correlated asset.

The Bottom Line

The shift is already happening - I'm getting emails from investors who've never touched gold before - suddenly asking how to get started, and hundreds of new GoldBuzzers are joining us each week.

In uncertain times, whether you're stacking physical bars, buying mining stocks, or eyeing ETFs, increasing numbers of us, from all over the world, are considering gold as the economic airbag.

As the AI narrative unfolds - with AI-related capital expenditures surpassing the U.S. consumer as the primary driver of economic growth in the first half of 2025 - staying grounded in gold could be the move that safeguards your future. When the music stops on this AI party, those holding real assets will be the ones still standing.

That’s all for Thursday, folks. I’ll look forward to seeing you on Sunday for the weekend update.

Before you go, please take a moment to rate today’s newsletter and let us know how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com