Happy Thursday, GoldBuzzers.

Markets are taking a breather after Tuesday's fireworks, and honestly? Both metals earned it. Gold's cooling off from its $4,500 flirtation while silver nurses its wounds below $80. We'll look at the jobs data everyone's obsessing over and what it means for rate cuts.

But the real story today is buried in Tennessee. The Pentagon just became a 40% equity partner in a massive new smelting facility - and if that doesn't make your ears perk up, you're not paying attention. This one’s important, so stick around for today’s Real Talk.

Ok. Let's dig in. ⛏️

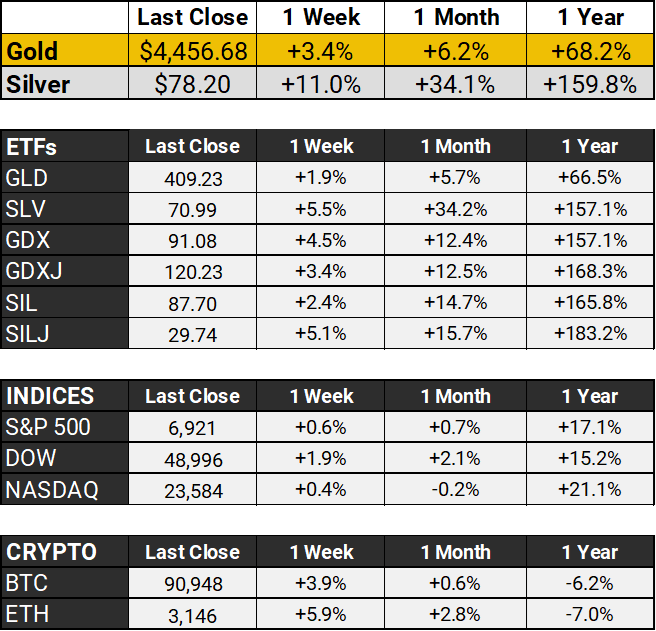

The Scoreboard 🏆

Gold pulled a classic "morning after" move on Wednesday, slipping back to $4,456 after briefly flirting with $4,500 like it was testing the water at a cold pool. It was overdue a breather after Tuesday’s Venezuela-fueled rally.

The ADP jobs report just dropped a reality check - only 41K new private sector jobs versus the expected 47K, while job openings hit a one-year low. But here's the plot twist: the services sector is apparently thriving like a houseplant you forgot to water that somehow gets stronger.

Markets are now pricing in two Fed rate cuts this year, with FOMC's Neel Kashkari basically saying "if unemployment goes up, we might actually do something about it." Friday's payrolls report is the next big catalyst, so expect volatility to pick up soon.

Meanwhile, silver's having its own identity crisis below $80 after nearly touching record highs again. With Bank of America's Michael Widmer calling for potential silver prices between $135-$309 (yes, you read that right), and chronic supply deficits meeting explosive industrial demand, this pullback might just be the dip silver bulls have been praying for.

Bottom line: Both metals are catching their breath, but the fundamentals remain stronger than your coffee order on a Monday morning. Central banks are still hoarding gold like it's toilet paper in 2020, and silver's industrial demand from solar panels and EVs isn't going anywhere but up.

Real Talk 🎯

The Pentagon Is Now in the Smelting Business (And What It Means for Silver)

Last week, while the world was focused on fireworks in Caracas, something equally significant happened in Tennessee.

Korea Zinc - the world's largest zinc smelter and second-largest silver refiner - announced a $7.4 billion deal to build a massive smelting facility in Clarksville, Tennessee. The kicker? The U.S. Department of Defense is taking a 40% stake in the joint venture.

Read that again. The Pentagon. Forty percent. Of a smelter.

This isn't a loan. It's not a subsidy. The U.S. military is becoming a business partner in metals processing on American soil.

Why This Matters More Than You Think

The facility will process 13 different metals - zinc, lead, copper, gold, silver, plus critical minerals like indium, gallium, and germanium. Eleven of those 13 are on the USGS critical minerals list. Several, including indium and gallium, are currently 100% imported - mostly from China.

Korea Zinc's existing facility in South Korea produces roughly 64 million ounces of silver annually, making it the world's largest single-site silver producer. The Tennessee plant is expected to operate at roughly half that capacity, potentially adding 30+ million ounces of domestically-refined silver to U.S. supply.

For context: that's about 3-4% of global silver supply. Not transformational on its own - but a meaningful shift for a country that currently ships most of its concentrates offshore for processing.

The Venezuela Connection (Sort Of)

Now here's where it gets interesting - though perhaps not in the way you'd expect.

The Korea Zinc deal was announced on December 15th. Two weeks later, U.S. forces captured Nicolás Maduro in Caracas. The temptation is to connect the dots directly: build the smelter, secure the resources.

But Venezuela's mining sector is a disaster. Production has collapsed by more than 90% over the past two decades. The Arco Minero del Orinoco - supposedly rich in gold, coltan, and critical minerals - is controlled mostly by criminal networks and armed groups. Reliable geological data barely exists. Analysts at CSIS and Fitch Solutions say it would take a decade of sustained reform, hundreds of billions in investment, and a complete overhaul of Venezuela's mining code before the country becomes a meaningful mineral producer.

So if anyone's expecting Venezuelan silver to flow through Tennessee by 2030, they'll be disappointed.

What is interesting is the shared strategic mindset behind both moves. As one analyst at Tufts put it: "Perhaps just as important [as oil] is that Venezuela has significant deposits of gold, rare earth elements and other critical minerals. Tensions with China have made clear the huge importance of all these minerals."

The Korea Zinc facility is designed to process concentrates from the Americas - think Chile, Peru, Mexico, Argentina. Venezuela may eventually be part of that picture, but the infrastructure is being built regardless. The U.S. is preparing for a world where Latin American minerals are processed domestically, not shipped to China. Whether Venezuelan resources ever factor in is almost beside the point.

Can You Invest in This?

Here's the frustrating part: not directly.

Korea Zinc trades on the Korean Stock Exchange (ticker: 010130.KS). There's no U.S. ADR or OTC listing. You'd need an international brokerage account with Korean market access - possible through Interactive Brokers or Schwab Global, but not exactly convenient.

The joint venture entity - Crucible JV LLC - is private. No public investment vehicle has been announced.

So this isn't a "buy this ticker" story. It's a "watch this trend" story.

The Bigger Picture

I think what's significant isn't so much the deal itself - it's what it signals.

When the Defense Department takes an equity stake in a smelter, it's telling you something: critical minerals are no longer just commodities. They're strategic assets, subject to the same geopolitical calculus as oil and natural gas.

JP Morgan Chase helped facilitate the deal, as part of their reported $1.5 trillion commitment over the next decade to secure US supply chains.

China controls 90%+ of rare earth processing capacity globally. The U.S. is late to this game - but the Korea Zinc deal suggests they're finally showing up.

For precious metals investors, the implications are bullish:

Domestic refining capacity means domestic demand for Latin American concentrates

Government involvement legitimizes the sector - expect more capital to flow into critical minerals

Silver's dual role as precious metal and critical industrial input gets reinforced

The Tennessee facility won't be operational until 2029. This is a long game. But the direction is clear - and if you're positioned in physical silver and quality miners, you're on the right side of it.

That’s all for Thursday’s update, folks. See you Sunday for the full round-up.

Before you go, please take a moment to rate today’s newsletter and let us know how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com