Happy Tuesday, GoldBuzzers!

What a difference a week makes. The metals are clawing their way back from the abyss, China's still stacking, and silver just reminded everyone why volatility cuts both ways.

I've got your Tuesday market recap below - plus a deep dive into the second most popular question I get asked!

Let’s get into it. ⬇️

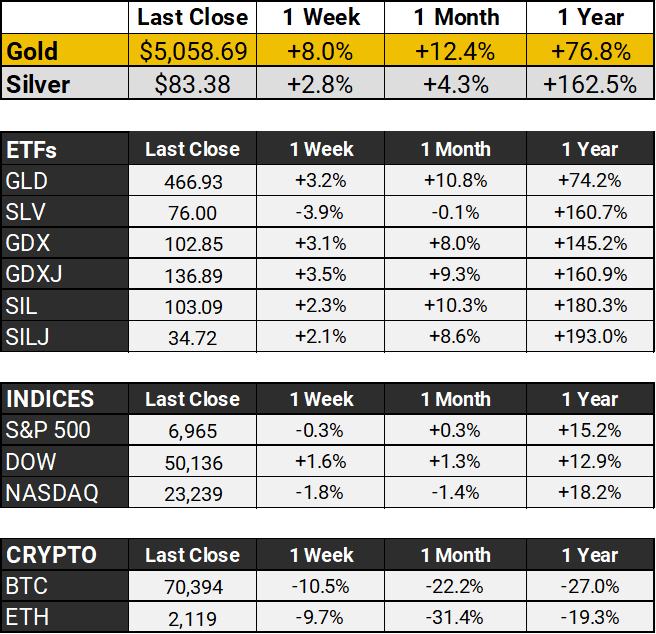

The Scoreboard 🏆

Gold punched back above $5,000 on Monday, rallying over 2% to around $5,058 as the dollar wobbled and investors continued scooping up the dip from late January's historic selloff - remember when we briefly visited $4,400 territory? That feels like a fever dream now.

US inflation expectations hitting a six-month low at 3.1% gave the yellow metal fresh tailwinds, while China's central bank kept the faith, extending its gold-buying streak to 15 straight months - Beijing doesn't seem fazed by the volatility, and neither should you.

But the real fireworks were in silver: the white metal exploded over 6% over $83, clawing back from the carnage that briefly erased nearly half its value after hitting $121 just two weeks ago. Japan's weekend election landslide for PM Takaichi added fuel to the precious metals fire, with her expansionary playbook giving the debasement trade a fresh lease on life.

US-Iran talks in Oman took some immediate heat off the geopolitical stove without extinguishing the underlying risks, so hedging demand isn't going anywhere. All eyes now turn to this week's jobs and CPI prints - if the data comes in soft, expect the metals to keep running.

Take Action Tuesday 📅

The Same Gold, Taxed Four Different Ways

Of all the emails I get from GoldBuzz readers each week, one question comes up more than any other: when should I buy? Especially from those of you who've read about the Theseus research project. You want the signals. You want the timing.

The good news: it's coming. The signals have been supplied daily to a small group of testers over the past year, covering gold, silver, miners, and Bitcoin. It’s doing what over 50 years of data said it should, and I'll be opening it up to a wider audience soon. More on that in the next few weeks.

But the second most common question is just as important, and it's the one I’m tackling today: how should I own my gold and silver? Not what to buy - but where and how to hold it.

Because the same ounce of gold, held in different structures, can produce wildly different outcomes when it comes to taxes, accessibility, and legal protection - whether you're in Texas, Toronto, or Tunbridge Wells! Think of it like real estate - owning a house outright, owning it inside an LLC, or holding it in a trust are three very different things, even though it's the same house.

So let's walk through your main options.

The Brokerage Account

This is where most people start, and it's the easiest path. Buy GLD, IAU, or SGOL through your regular brokerage, and you've got gold exposure in minutes. Simple, liquid, done.

But here's the catch: in the US, the IRS treats physically-backed gold ETFs as collectibles. That means long-term capital gains are taxed at up to 28% - not the 15-20% you'd pay on stocks. And if you sell within a year, you're paying ordinary income rates, which could mean 37%. Mining stocks and mining ETFs like GDX get the standard capital gains treatment, but anything backed by physical metal gets the collectibles haircut. A lot of investors don't find that out until tax season.

Personal Possession

Coins in a safe. Bars in a vault at home. There's something satisfying about holding your gold in your hands - no counterparty risk, no digital dependencies, no accounts to hack.

But there are no tax advantages here. When you sell, any gains are still reportable and still taxed at that 28% collectibles rate in the US, or subject to capital gains in Canada and the UK. And you may want insurance, a quality safe, and a plan that doesn't involve telling everyone at dinner about the gold buried in your backyard!

Offshore Vaulting

This is the jurisdiction diversification play, which I recommend. Services like BullionVault let you buy and store allocated gold in vaults in Zurich, London, or Singapore - outside the banking system, outside your home country, and spread across legal jurisdictions.

The appeal is real: Swiss vaults aren't going to get swept up in a domestic banking crisis or a local legal dispute. But for US persons, there's no tax escape - you still owe capital gains when you sell, and depending on the structure, you may have FBAR and FATCA reporting requirements. The benefit is diversification of custody, not diversification of tax obligation.

Tax-Advantaged Accounts

Now we get to the option most people overlook - and the one where the math changes the most.

US readers: A Gold IRA lets you hold physical metal inside a traditional or Roth IRA. Traditional means tax-deferred growth - you dodge that 28% collectibles rate entirely while your physical gold (or silver) sits in the account. Roth means tax-free qualified withdrawals. The trade-off: you need a specialized custodian and IRS-approved depository and you can't touch it before 59½ without penalties. It generally makes sense for accounts over $50,000 where fees become a rounding error.

Canadian readers: You can hold gold ETFs or even physical bullion (99.5%+ purity) inside an RRSP or TFSA. An RRSP gives you a tax deduction on contributions and tax-deferred growth - similar to a traditional IRA. But the real gem is the TFSA: gains are completely tax-free, and unlike an RRSP, you can withdraw anytime without penalty. If you're holding a gold ETF like Sprott's PHYS inside a TFSA, that gold appreciation is yours to keep, every dollar of it.

UK readers: You can't hold physical gold inside an ISA, but you can hold gold ETFs in a Stocks & Shares ISA - and gains are completely free from Capital Gains Tax. For physical gold, a SIPP (Self-Invested Personal Pension) lets you hold gold bars with CGT-free growth, though you can't access it until age 57. And here's a uniquely British advantage: Royal Mint coins - Britannias and Sovereigns - are classified as UK legal tender and are entirely CGT-exempt. No limit, no allowance to worry about. With the CGT-free threshold now just £3,000, that's a meaningful edge.

The Bottom Line

There's no single right answer here. A lot of serious gold investors use more than one of these structures - a core retirement position in a tax-advantaged wrapper, some physical at home for peace of mind, maybe an ETF in a brokerage for liquidity.

What matters is that you're making a deliberate choice about where your gold lives - not just defaulting to whatever was easiest and discovering the tax implications later.

For US readers with $50k+ in an existing IRA or old 401(k), rolling a portion into physical gold or silver is worth a closer look. I've put together a detailed guide on how Gold IRAs work, what the fees look like, and what to watch out for - you can read it here.

Whatever structure you choose, the important thing is that you're choosing deliberately - not finding out the hard way at tax time.

That’s all for this Tuesday, folks. Stay safe and I’ll see you on Thursday.

Before you go, please take a moment to rate today’s newsletter and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com