Happy Sunday, GoldBuzzers!

We're back from the holidays and the metals are STILL on fire. 🔥

A very warm welcome to the almost 500 new faces that have joined our community since we last published before Christmas.

I hope you had a much-needed rest and are looking forward to the opportunities that lie ahead.

In today’s Deep Dive, I’ll be examining why the silver market might be about to break in 2026.

Ok, let’s dive in!

Today’s Vibe 😂

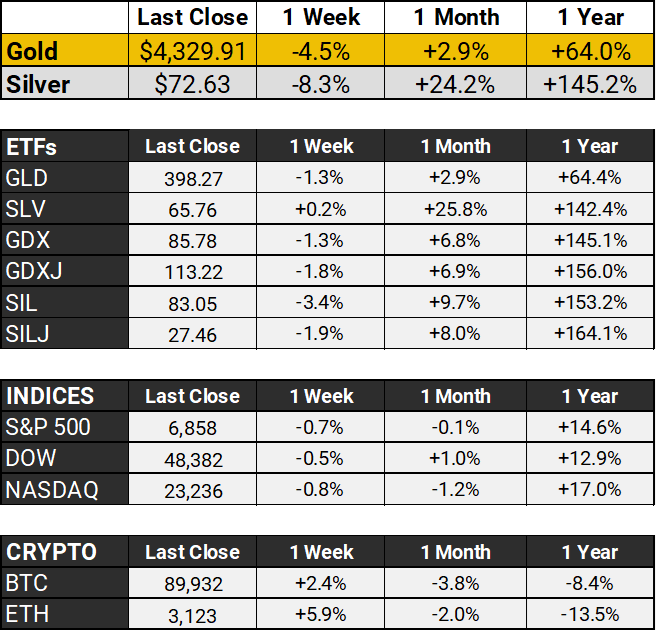

The Scoreboard 🏆

Gold kicked off 2026 trading around $4,330 per ounce, extending its monster rally from 2025's 64% gain - the best percentage gain since 1979. But the real MVP? Silver. The white metal surged toward $73 per ounce after absolutely demolishing records last year with a face-melting 145% surge.

The FOMC's December minutes showed growing openness to rate cuts if inflation continues to ease, though the Fed's still playing coy about timing.

Meanwhile, geopolitics just went nuclear - the U.S. carried out a large-scale strike against Venezuela early Saturday and "captured" the country's president, Nicolás Maduro. Holy regime change, Batman!

And that's not all. Iran is six days into its biggest protests since 2022, with at least seven dead and Trump threatening intervention ("locked and loaded"). Tehran fired back, warning U.S. troops in the region could be targeted.

This massive escalation adds rocket fuel to safe-haven demand. Bank of America sees gold reaching $5,000 an ounce due to continued central bank buying, rising deficits tied to U.S. fiscal policy, and a weaker U.S. dollar, while silver's getting love from its designation as a critical US mineral, tight supply conditions, low stockpiles, and strengthening industrial and investment demand.

Bottom line: With Venezuela in chaos, Iran on the brink, and global tensions exploding, the metals party isn't slowing down anytime soon. 🚀

Deep Dive 🔍

The Silver Squeeze 2.0: Banks on the Brink as Physical Demand Explodes

As we kick off 2026, the silver market is teetering on the edge of a historic upheaval. What began as whispers of a "silver squeeze" in late 2025 has erupted into a full-blown confrontation between paper markets and physical reality.

The core issue? A dramatic decoupling. While futures prices on COMEX hover around $71-75 per ounce, physical silver in Shanghai is commanding $80-$86 - a spread that should close through arbitrage within hours. It's not closing. That tells you something's broken.

Paper vs. Physical: The Great Disconnect

Paper silver - futures contracts traded on exchanges - represents leveraged bets on price movements, often without actual metal backing. These contracts have historically allowed institutions to suppress prices through massive short positions, creating an illusion of abundance.

But that illusion is cracking.

The visible symptom is the sharp depletion of global inventories. COMEX registered inventories have fallen over 70% since 2020. London vaults have lost around 40% of their holdings. Shanghai sits at decade lows. At current consumption rates, some industrial regions have barely 30-45 days of accessible silver reserves.

Banks are at the epicenter, defending key price levels to avoid cascading liquidations. The CME Group's recent margin hike to $25,000 per contract - their way of cooling speculative excess - triggered a 12-15% pullback right before the holidays. Classic volatility dampening, or something more deliberate? You can draw your own conclusions. Remember, JPMorgan paid $920 million in 2020 for spoofing silver markets.

China Changes the Game

Supply shortages are amplifying the pressure. Global silver production lags demand by 100-250 million ounces annually, with 2025 marking the fifth consecutive deficit year.

And as of January 1, China threw gasoline on the fire.

Beijing's new export restrictions require special government licenses for refined silver exports. To qualify, firms must have annual production capacity of at least 80 tonnes. This effectively blocks hundreds of smaller exporters who've supplied global markets for years - locking away an estimated 60-70% of global refined supply.

Sound familiar? It's the same playbook China used with rare earths.

Insatiable Demand

Meanwhile, industrial demand shows no signs of slowing. Silver's role in green tech - comprising 50-60% of total consumption - has no viable substitutes. Solar panels, EVs, AI chips - they all need silver, and the deficit has now stretched five years running.

This echoes the 1980 Hunt Brothers squeeze, but with a critical difference: today's deficit is structural, not speculative. There's no easy mining ramp-up. Silver is mostly a byproduct of other mining operations, and new primary mines take a decade to develop.

What Happens Next

Looking ahead, the setup is unlike anything I’ve seen since 2008-2011, when silver ran from $9 to $49.

Experts are forecasting continued gains. Some see $100 as achievable in 2026; others point to $125 or higher if physical shortages intensify. The recent 12-15% pullback? That’s a normal shakeout behavior in a bull market.

But risks remain. Paper holders could face force majeure clauses - settlements in cash at suppressed prices rather than physical delivery. If even a small fraction of futures holders demand actual metal, the market faces a scenario where there simply isn't enough silver to meet contractual obligations.

The Theseus research indicates that triple digit Silver is inevitable within this cycle based on historical patterns, but you're going to have to get used to a lot more volatility than we've experienced before. 5%-10% up and down days will become far more commonplace and a lot of people will get shaken out of their positions on the way to those highs.

That 4-year research has now been extended to develop practical timing signals for gold, silver, ETFs and mining shares - helping you capture the major trends rather than getting shaken out. I already use them myself, and I'll finally be making them available to GoldBuzz readers later this year. Watch this space.

The Bottom Line

This squeeze isn't just financial - it's a reckoning for a system where paper claims vastly exceed physical supply. Retail investors holding actual metal have leverage they've never had before.

With inventories draining and China hoarding supply domestically, 2026 could see silver's true value finally emerge. The structural deficit isn't going away. The question is how long paper markets can hold the line.

For stackers, the message is straightforward: understand what you own, and why you own it. The real breakout may be closer than the charts suggest.

Your Take 🤔

I want to know what you think. Cast your vote in today’s reader poll and I’ll share the results next Sunday.

Predict the highest Silver price this year

That’s all for this Sunday, folks! I’ll see you on Tuesday.

Before you go, please take a moment to rate today’s GoldBuzz and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com