Happy Thursday, GoldBuzzers!

I have a confession. Watching the relentless price rise of gold and silver again on Wednesday left me with a bittersweet feeling. I’m reminded of the old saying:

Be careful what you wish for, lest it come true!

When I completed the Theseus research in the spring of 2024, I knew that we were about to witness one of the great bull markets in history.

That’s the reason I decided to found GoldBuzz, to spread awareness of what was coming.

So, on the one hand, it’s wonderful to see all that work vindicated, but on the other hand the speed of ascent of both gold and silver are signalling tough times ahead, because something’s seriously wrong with our global economies.

Silver in particular is sending a signal that requires our close attention, and that’s the focus of today’s Real Talk.

By the way, a few of you have told me that your newsletters are getting truncated in Gmail and you have to click to read the whole email. There’s so much to say in each edition, but I’m going to try to keep today’s a little shorter!

OK, let’s dive in.

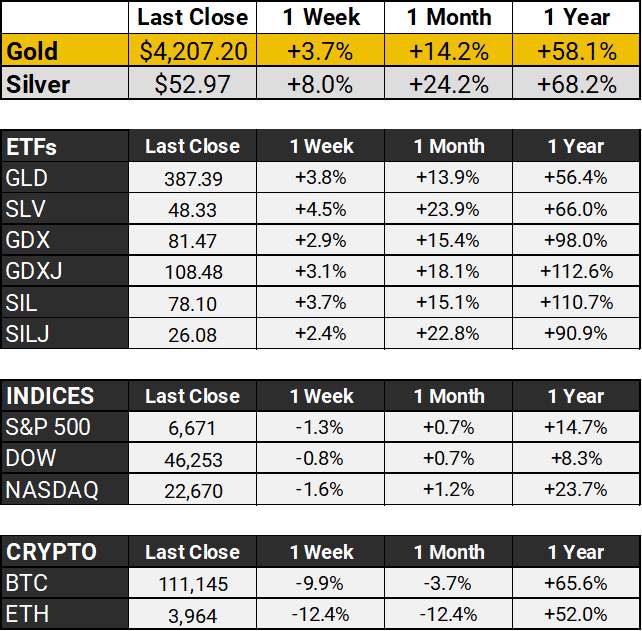

The Scoreboard 🏆

Gold surged above $4,200 per ounce Wednesday, notching yet another record high as safe-haven demand intensified amid a perfect storm of monetary policy shifts and geopolitical turmoil.

Fed Chair Powell's remarks at the NABE meeting yesterday acknowledging rising employment risks fueled expectations for additional rate cuts through year-end, weakening the dollar and boosting bullion's appeal.

The ongoing U.S. government shutdown, now in its third week, continues to cloud economic data and add to market uncertainty, further supporting gold's relentless rally as investors flee to the precious metal's traditional safety.

Meanwhile, Silver continues to go ballistic, up 8% on the week and almost 25% on the month. Let’s take a closer look.

Real Talk 🎯

There's Something Wrong with the Silver Price

As I write this on Wednesday evening, just after the markets closed, I’m looking at something very strange. The spot Gold price is $4207.20 and the Futures price is $4224.90. That’s as you’d expect - the Futures price is higher than the spot price.

Why? The spot price is the price you pay for immediate delivery. But if you're a commodities trader, or you manufacture solar panels, and you need to guarantee delivery in November or December, then you pay the futures price. The futures price is nearly always higher than spot (called 'contango') because it has to include additional costs like storage, insurance, and financing.

However, what’s happening now in the Silver market, is the opposite and it means that something is broken. The spot price for immediate delivery is HIGHER than the futures price.

I'm talking about backwardation. Front-month silver futures have been trading up to $2.88 higher than contracts for later delivery. That's the steepest inversion in over four decades.

In normal markets, you pay more for future delivery. Storage costs money. Time has value. The curve slopes upward.

When it flips, something's wrong with supply.

What Backwardation Actually Signals

Backwardation means people need physical metal now more than paper promises for later. Industrial users can't wait. Investors want delivery, not contracts.

The futures market is screaming one thing: there's not enough silver to go around.

On October 9, lease rates hit 39% before settling around 32%. Normal silver lease rates hover below 1%. Even July's 6% spike looked tame by comparison.

Market insiders are saying "nobody's got silver" and many dealers are out of stock. When you can find someone willing to lend, they're charging 20-30% if you're lucky.

That's not a market. That's a squeeze.

The Physical Reality

The backwardation isn't isolated to front months. The entire futures curve through 2026 shows inversion. December 2025 contracts trade at a discount to spot. Physical premiums on popular bullion coins are running 10%+ over benchmark prices.

Traders are paying above spot. Not as an anomaly. As the new normal.

Meanwhile, ETFs absorbed 95 million ounces in the first six months of 2025 alone, pushing global holdings to 1.13 billion ounces. That's more than all of 2024's inflows combined.

Industrial demand hit 680.5 million ounces in 2024 and looks set to cross 700 million for the first time in 2025. Solar panels alone now account for 232 million ounces, a 96% surge from 2022 levels.

Mine production? Down 7% since 2016.

What History Suggests

The last time silver showed such significant backwardation was 1980 and 2011. Both preceded explosive moves. Silver gained 71% and 75% respectively within months of those inversions.

But here's the thing. Those rallies were driven by speculation and momentum. This one looks different. Because it is.

Today's backwardation stems from real-world constraints. Industrial demand isn't speculative. It's mandatory. Solar panel manufacturers have to have silver whether it's $30 or $130. Electric vehicles need it. AI servers need it. You just can't build these things without silver.

Investment flows are responding to reality, not driving it.

The Triple-Digit Case

Adjusted for inflation, silver's 1980 peak of $48 per ounce equals roughly $199 in today's dollars. Silver hasn't made a real new high in over forty years.

To simply match its inflation-adjusted 1980 high, silver needs to 4x from here.

Technical analysts point to a cup-and-handle formation targeting $400. The break above the 45-year resistance between $36-49 isn't nothing. The game has changed.

The Transformation Underway

Physical demand is finally calling the shots now. Paper contracts used to set prices. That system is cracking.

When front-month contracts trade at premiums to later delivery across an entire year's curve, you're watching a market repricing itself live.

What comes next depends on whether mines can keep up with demand at all. The paper-driven pricing era looks like it’s coming to an end.

That’s a wrap for Thursday, folks. I tried to keep it a little shorter! See you all on Sunday.

Before you go, please take a moment to rate todays’ newsletter and let us know how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com