Welcome back, GoldBuzzers.

Well, that was fun. Silver decided to audition for a horror movie this week, plunging 30% before remembering it's still in a bull market.

Gold played the responsible older sibling, as usual. I’ve just spoken with Andrew Sleigh from Sprott Money to help dig beneath the surface - and what he told me about physical supply is worth your attention.

Ok. Let’s get into it!

Today’s Vibe 😂

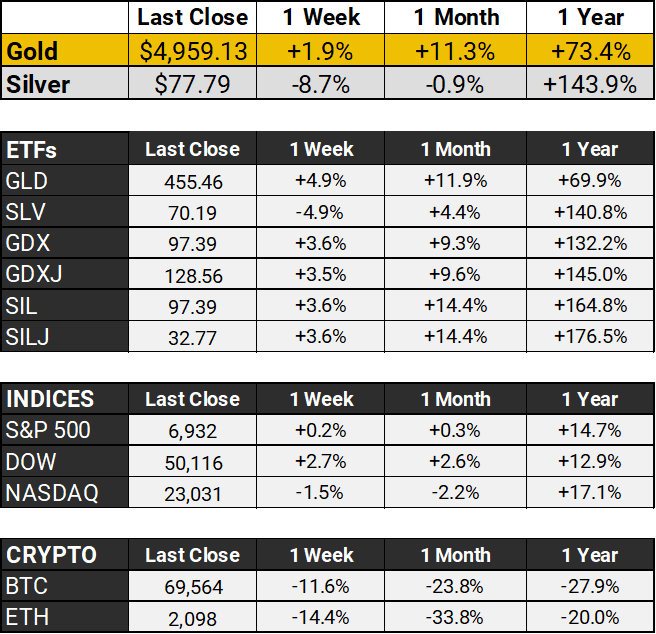

The Scoreboard 🏆

Gold clawed its way back above $4,950 on Friday after one of the wildest rides in years - we're talking 3.5%+ daily swings that had traders reaching for the Tums. The recovery came after late January's margin call massacre, when leveraged ETFs mechanically unwound and silver's spectacular faceplant from $121 to the $70s dragged the whole complex down with it.

This week's rebound? Weaker US jobs data (231K initial claims, 108K announced cuts in January) reminded everyone the Fed might actually cut rates later this year, while US-Iran talks in Oman getting described as "a good start" cooled some of the geopolitical heat without fully removing it.

Silver bounced back toward $78 but remains roughly 35% below its January 29th peak - and if you're wondering whether retail got shaken out while the usual Wall Street players reloaded, you're not alone. The bull market just got a lot more interesting.

Deep Dive 🔍

Volatility, Revaluations, and a Bullion Dealer Who Can’t Get Silver

That was some week. Silver plunged over 30% in a single session before clawing back to around $78 by Friday's close. Implied volatility spiked past 100% - levels that make even seasoned investors reach for the whisky. Gold, ever the steadier sibling, absorbed the punishment and clawed back almost half its losses, closing near $4,960 on Friday. A 3% weekly gain while silver was getting beaten up is a reminder of who's driving this car.

I spoke with Andrew Sleigh at Sprott Money again this weekend, to get his read on the week. Not a full interview this time - more of a temperature check.

The physical supply squeeze is getting worse.

When we last spoke two weeks ago, Canadian Silver Maples were running 3 weeks for delivery. That's now up to 5 weeks. Sprott just received an allocation of 20,000 maples from the Royal Canadian Mint, with no confirmation of any further allocation this month. Meanwhile, premiums on 100 oz silver bars in the US have jumped from $1.90 over spot to $5 - in roughly a month. Eagles are running $16-17 over spot.

And it's not just North America. Reports out of Switzerland - home to Valcambi, Argor-Heraeus, and Metalor, three of Europe's biggest refiners - indicate that the country's largest dealer can't source silver at all. When product arrives, it's gone in seconds. India continues to run short. The pattern keeps on repeating.

Andrew's outlook has tempered since our first conversation, when he believed $200 silver could be here by February. Those projections, he told me, were "before manipulation got involved." But he's not bearish. He expects gains next week, and the technical picture - a potential double bottom with silver bouncing off the $60s twice - supports that.

Two dates are circled on his calendar.

The Shanghai Gold Exchange will be closed between February 15-23 for Chinese New Year. If last Friday taught us anything, it's that these closures create the conditions for exactly the kind of sell-off we just lived through. Then in late February, traders can begin standing for delivery on March COMEX contracts - the largest delivery month of the year.

Andrew says only about 15% of outstanding contracts are covered with physical metal. If significantly more than that stands for delivery, nobody quite knows what happens, because it's never happened before. The contracts have force majeure clauses allowing cash settlement, but if that card gets played, whatever confidence remains in paper silver pricing goes with it.

The CME's margin hikes are a clear signal that regulators are bracing for more turbulence. But this shakeout could be exactly what the market needs - purging the weak hands and setting the stage for the next leg up. Dip-buying has paid off historically, and retail options volume has surged to 6.6x 2023 levels. The interest isn't going away.

Beyond the volatility, there are bigger forces at work.

The revaluation narrative is gaining traction. The US still values its 8,100 tons of gold reserves at $42.22 per ounce - set in 1973. At current market prices around $5,000, that's trillions in unrealized value sitting on the government's books. Judy Shelton, a former Trump economic advisor, has proposed gold-linked Treasury bonds and a potential revaluation timed for July 4th - the nation's 250th anniversary.

Whether you file that under "fiscal innovation" or "tinfoil hat territory," the Federal Reserve itself published a research paper last year examining how other nations have used gold revaluations. It's a narrative worth watching.

Globally, central banks are pivoting. A 30-year trend reversal has seen reserves shifting toward gold and away from the dollar. That structural bid isn't going away regardless of what happens week to week.

And then there's India - the wildcard. Starting April 1st, the Reserve Bank of India will allow silver to be used as loan collateral for the first time, at a 10:1 ratio to gold.

Ten kilograms of silver equals one kilogram of gold for lending purposes. With an estimated 10,000-15,000 tonnes of silver sitting in Indian households and temples, this remonetization could unlock enormous demand for physical metal and further tighten an already strained global supply chain. It's the first time a major economy has formally recognized silver's monetary role in modern banking, and that’s highly signifcant.

Gold is driving this bull market. Silver is the volatile teenage offspring along for the ride. But the fundamentals - supply deficits, central bank buying, revaluation speculation, and India's policy shift - haven't changed because of one very rough week.

If anything, they’re continuing to get stronger.

Why Physical Ownership Matters

Here's something worth thinking about after a week like this. Banks, pension funds, insurers - they're all tangled up in a web of IOUs, credit swaps, and undelivered assets where A owes B who's hedged with C who's insured by D... who turns out to be A. Gold accounts, ETFs, and futures don't get you out of that web - they're part of it.

The only way to truly opt out is to own physical metal outright. That's exactly what BullionVault is built for. You get direct ownership of real, allocated gold and silver stored in professional vaults across multiple countries - London, Zurich, Singapore, New York, Toronto. No counterparty risk. No paper promises. Your metal, in your name. I use it myself and recommend it to friends and family. Try BullionVault free and get a starter amount of silver to test it out →

That’s all for this Sunday, folks! I’ll see you on Tuesday.

Before you go, please take a moment to rate today’s GoldBuzz and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com