Happy Tuesday, GoldBuzzers!

If you blinked yesterday, you missed precious metals making history - again. While Wall Street was closed for MLK Day, gold and silver decided to stage their own celebration, with both metals smashing through to new all-time highs on President Trump's latest tariff threats.

I've got the full breakdown below, plus today's Take Action Tuesday feature: a deep dive into the bullion dealer I've been personally using to stack physical metal on both sides of the border.

Let's get into it. ⬇️

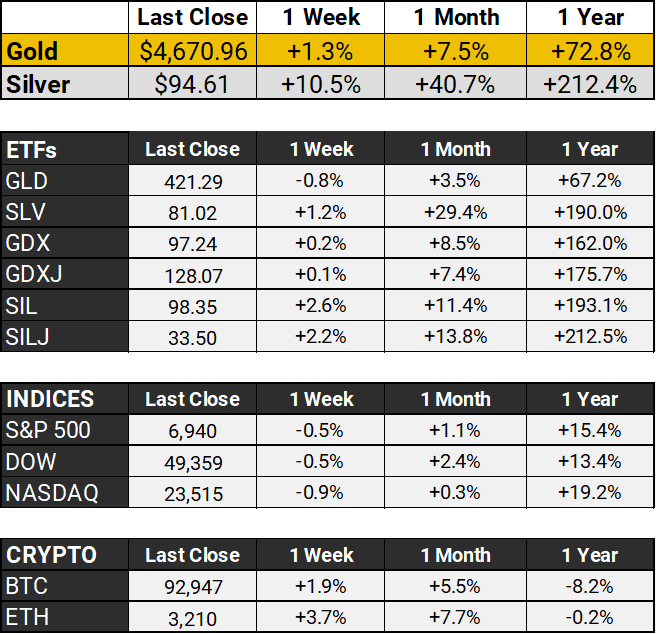

The Scoreboard 🏆

Wall Street took the day off for MLK Day on Monday, but precious metals apparently didn't get the memo. Gold blasted past $4,670 to hit yet another all-time high - up nearly 2% on the day - after President Trump announced 10% tariffs on eight European nations starting February 1st, with a not-so-subtle threat to jack them up to 25% by June if Europe doesn't play ball on his Greenland ambitions.

European leaders are now scrambling to coordinate a response, with €93 billion in retaliatory tariffs reportedly on the table. But the real fireworks? Silver absolutely ripped (again), surging more than 5% to $94.61 and smashing through to another record high.

Silver got an extra boost after Trump's team decided NOT to slap tariffs on critical minerals - which includes silver, thanks to its new status on the US critical minerals list.

Add in those persistent supply deficits and London squeezes we've been tracking, and silver is officially outpacing its big brother gold by a wide margin in 2026. If you've been sitting on the sidelines wondering when precious metals would make their next move... well, they just did.

Take Action Tuesday 📅

Where I Actually Buy My Coins

Over the past month, I've been traveling through Canada and the United States. I can tell you it's been a wonderful change of pace to go from -20°C days in Canada to +20°C days in the States!

While traveling, I've also wanted to keep stacking - which gave me a perfect opportunity to test different options and find the best ones to recommend in GoldBuzz.

The easiest by far has been allocated storage through BullionVault, as I discussed last week. It’s so easy to buy small amounts at any time, day or night.

But what if you want coins and bars shipped directly to your door?

If you read my interview with Andrew Sleigh last Sunday, you'll know that's becoming increasingly challenging as dealers are experiencing growing shortages and delays.

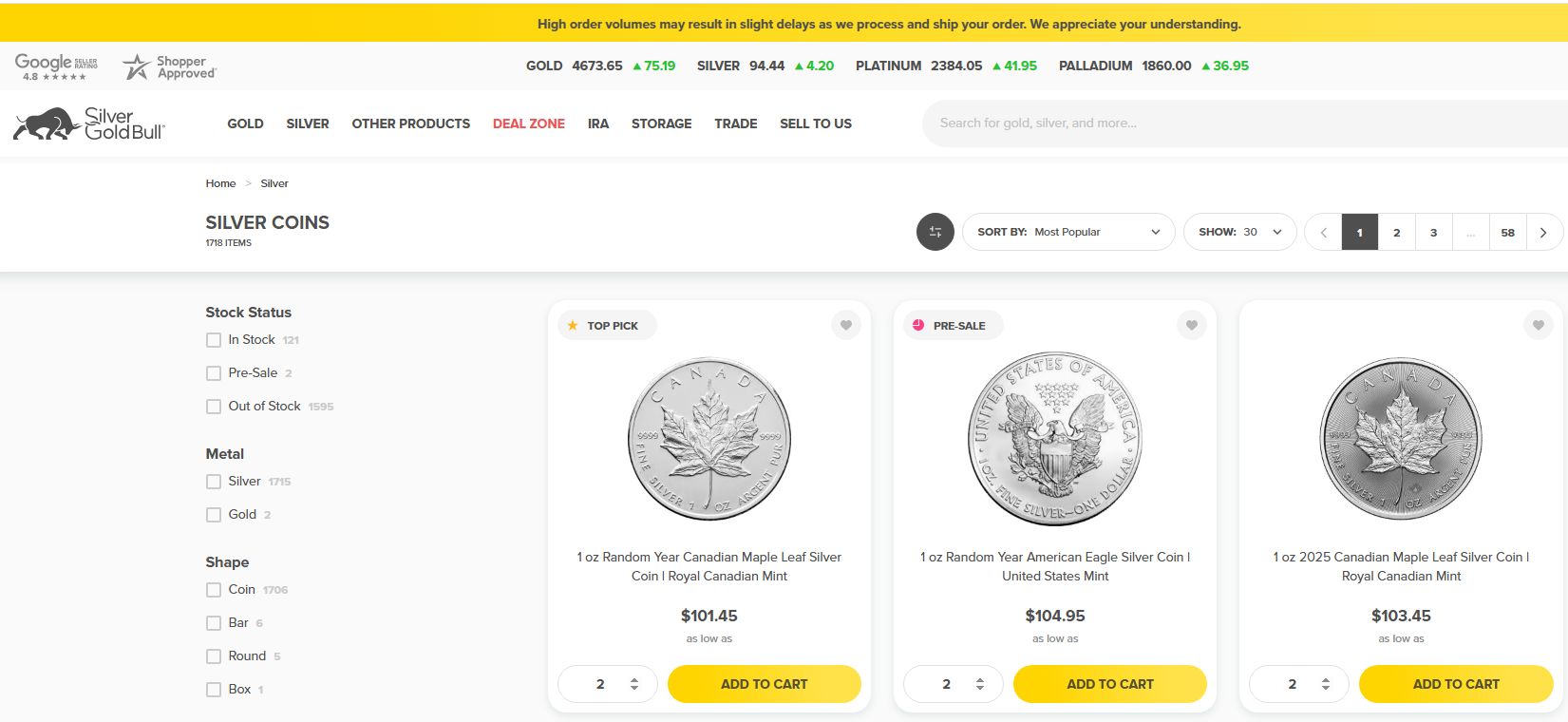

However, I've had good experiences over the past few weeks dealing with Silver Gold Bull, and they're the subject of today's feature.

What Is Silver Gold Bull?

Founded in 2009 in Calgary by the Belandis family, Silver Gold Bull has grown into one of the largest bullion dealers in North America - over $3 billion in sales and counting.

They operate in both the US and Canada and their headquarters are in Las Vegas. Unlike BullionVault where you trade grams in a vault, Silver Gold Bull is a traditional dealer: you pick your coins or bars, pay, and they ship straight to your door.

Simple. No login screens to check your balance. Just metal in your hands.

The Fee Structure

Fee Type | Details |

Premiums | 3-5% over spot (competitive) |

Shipping | Free on orders over $199 |

Account Setup | Free |

Minimum Order | None |

Buyback | Yes (prepaid label, same-day payment) |

Returns | Within 2 days, 4% restocking fee |

They also have a price match guarantee which I’ve been impressed with. If you find the same product cheaper at a reputable competitor (including shipping), they'll match it (though I haven’t needed to test it out yet.)

✅ THE POSITIVES

Competitive premiums - 3-5% over spot beats most local dealers

Free shipping on orders over $199, fully insured

No minimum order - buy one coin if you want

Price match guarantee - they honor it

Massive selection - gold, silver, platinum, palladium, plus collectibles

Trading platform - buy fractional amounts at near-spot for storage

Six vault locations in four countries if you want storage

Fast shipping - typically 2-5 business days after payment clears

Excellent service reputation - 4.8 stars on Trustpilot, A+ BBB rating

US and Canada friendly - seamless for cross-border investors

❌ THE NEGATIVES

Premiums higher than BullionVault - because you're paying for physical delivery

ACH payments can be slow to clear - wire or card is faster

Some shipping delays reported during peak demand, but that’s becoming the norm with all dealers now

4% restocking fee on returns

Occasional quality complaints - scratches on older bars (they verify weight/purity, not cosmetics) but newer coins should be fine

Why I Personally Use Them

I believe everyone should have at least part of their stack in physical metals they can actually hold, and Silver Gold Bull is my go-to for that at the moment.

The premiums are fair - perhaps not the absolute cheapest if you hunt around, but competitive enough that I don't feel the need to price-shop every time. Also, the price match guarantee means I don't have to.

What I like is a good combination of selection and service. They carry everything from standard Maple Leafs and Eagles to more obscure sovereign coins. When I had a question about a shipment, I got a human on the phone in under two minutes. In the bullion world, that's rare.

👤 Best For:

Investors who want physical possession

Canadians and Americans (they serve both seamlessly)

Those building a stack over time with smaller, regular purchases

Anyone who values customer service and doesn't want to hunt for deals

Collectors looking for variety beyond standard bullion

🎯 Rick's Take

My impression is that Silver Gold Bull isn't trying to be the absolute cheapest dealer - and honestly, the ones who are, probably cut corners elsewhere. What they do offer is a reliable, well-priced, customer-friendly experience that makes buying physical metal quite straightforward.

For larger positions where I want the convenience of storage, I still prefer BullionVault. But for coins, or bars, Silver Gold Bull is what I’m using at the moment - in both the US and Canada.

So if you're building your first stack or adding to an existing one, I’d recommend them as a good option.

Ready to Try Silver Gold Bull?

Use the link below and you'll be supporting GoldBuzz at no extra cost to you - it's how I keep the newsletter free.

That’s all for this Tuesday, folks. I’ll see you on Thursday.

Before you go, please take a moment to rate today’s newsletter and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com