Happy Tuesday, GoldBuzzers!

Wow - what a way to kick off December!

Remember when silver at $50 felt like a stretch target? That was just three weeks ago. On Monday, the white metal blew past $58 - smashing all-time highs like they were speed bumps.

Gold's partying too, hitting $4,232 and its highest level in six weeks. If you've been positioned in precious metals this year, congratulations: you're watching history in the making.

Ok, let's dive in.

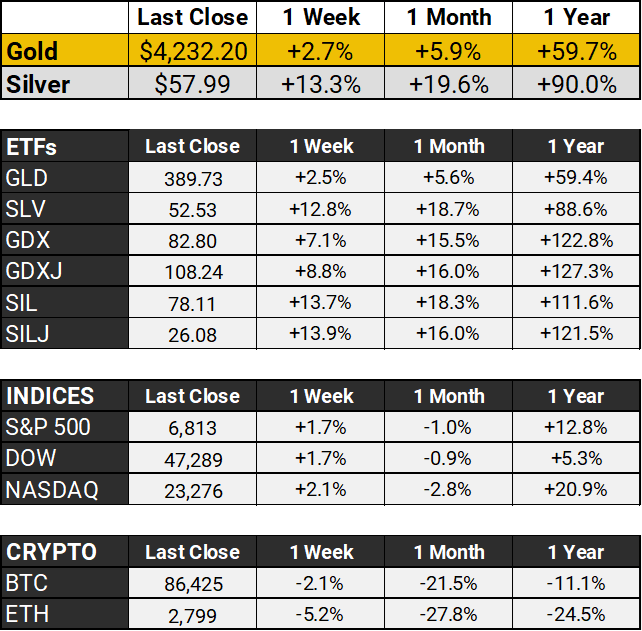

The Scoreboard 🏆

Gold rocketed to $4,232 per ounce on Monday, hitting its highest level in six weeks while silver went absolutely ballistic, at one point surging nearly 4% to $58.57 per ounce and smashing through yet another all-time high. Silver’s outperformance of Gold at the moment is quite staggering - up more than 13% in a week.

If you're not feeling the heat from these precious metals right now, check your pulse - because this market is on fire! Markets are now pricing in an 87% probability of a quarter-point Fed rate cut next week, and both metals are feeding off that energy.

Gold's already up a staggering 63% year-to-date, positioning for its best annual performance since 1979, while silver's gone completely parabolic with a mind-blowing 100% gain.

Shanghai silver inventories are hitting decade lows, the US just added silver to its critical minerals list (hello, potential tariffs!), and the gold-silver ratio is compressing faster than a Tesla battery - suggesting silver might just be getting warmed up. Buckle up, precious metals fans - December's starting with a bang! 🚀

Company Corner 🏢

Beyond SIL and SILJ: 4 Silver Mining ETFs on My Radar

If you hadn’t noticed - Silver's having a moment. The white metal has doubled in 2025, now trading at almost $58 per ounce after starting the year under $30. Industrial demand is surging (hello, solar panels and EVs), supply deficits are widening, and silver's role as "gold's faster little brother" is attracting serious attention.

Since my recent articles on the Global X Silver Miners ETF (SIL) and its junior sibling SILJ, I've heard from many of you who love the ETF approach - easy access, solid liquidity, no need to pick individual miners.

It's clear why SIL dominates the space with over $4 billion in assets.

But what if you want to diversify your silver miner exposure? Maybe you're looking for lower fees, a different approach, or just don't want all your eggs in one basket.

Good news: there are alternatives, and here's my choice of four other options worth your consideration.

The pitch: Think of SLVP as SIL's more cost-conscious cousin.

What you need to know | |

|---|---|

AUM | ~$662 million |

Expense Ratio | 0.39% (vs. SIL's 0.65%) |

Strategy | Tracks MSCI's global silver and metals miners index |

What's inside: You'll find familiar names like Industrias Peñoles (world’s largest producer of refined silver) and Hecla Mining. The fund holds about 28 stocks, which is narrower than SIL's broader basket, but still gives you diversified exposure across the silver mining space.

The trade-off: SLVP includes some "metals miners" that aren't pure silver plays, which slightly dilutes your silver-specific exposure. If you want every dollar working on silver, this matters. If you're okay with some diversification across related metals, it's a feature, not a bug.

Bottom line: SLVP is a solid choice if you're cost-conscious and want global silver miner exposure without paying SIL's higher fee. Over a multi-year hold, that 0.26% fee difference adds up.

The pitch: Why choose between miners and metal when you can have both?

What you need to know | |

|---|---|

AUM | ~$453 million |

Expense Ratio | 0.65% |

Strategy | ~82% silver miners + ~18% physical silver |

What's inside: SLVR launched in January 2025 and quickly crossed $100 million in assets - a sign the market was hungry for this approach. The fund holds 51 securities focused on "pure-play" silver companies (those getting at least 50% of revenue from silver), plus actual physical silver as a portfolio anchor.

Why it's different: That physical silver allocation is the secret sauce here. When mining stocks wobble (and they do - operational issues, management drama, permit problems), the physical silver provides some stability. It's like having a shock absorber built into your silver exposure.

The trade-off: It's a newer fund with limited track record. If that makes you nervous, fair enough. But Sprott has been in the precious metals game for decades, so they know what they're doing.

Bottom line: SLVR is particularly interesting for investors who want leveraged silver exposure through miners but worry about individual company risk. The physical silver component adds a layer of downside protection that pure miner funds don't offer.

The pitch: Let the pros pick the winners.

What you need to know | |

|---|---|

AUM | ~$134 million |

Expense Ratio | 0.89% |

Strategy | Actively managed, gold AND silver miners |

What's inside: GBUG launched in February 2025 as Sprott's first active ETF. The portfolio managers actively select around 37 holdings based on fundamental analysis - they're not just buying whatever index tells them to.

Why it's different: Two things stand out. First, it's actively managed, meaning real humans are making buy/sell decisions based on company fundamentals, management quality, and valuation. In a sector where there's huge performance dispersion between good and bad miners, smart stock-picking can really matter.

Second, it covers both gold and silver miners. If you believe in precious metals broadly but don't want to make a binary bet on silver vs. gold, GBUG lets you play both sides.

The trade-off: That 0.89% expense ratio is the highest on this list. Active management costs money, and you're betting the managers can earn their fee through better stock selection (so far this year they’ve underperformed the other funds). Also, if you want pure silver exposure, the gold miners in here will dilute that.

Bottom line: GBUG is best for investors who (a) believe active management adds value in mining stocks, and (b) want exposure to both gold and silver without managing two separate positions. Not a pure silver play, but a legitimate precious metals allocation.

The pitch: Maximum silver focus, minimum fees.

What you need to know | |

|---|---|

AUM | ~$6-7 million |

Expense Ratio | 0.35% (lowest on this list) |

Strategy | Tracks STOXX Global Silver Mining Index |

What's inside: AGMI launched in May 2024 and tracks an index of global silver miners. At just 0.35% expenses, it's the cheapest pure-play silver miner option available.

Why it's different: If you want the most cost-efficient way to bet on silver miners, AGMI is your fund. The fee is nearly half what SIL charges.

The trade-off: Here's the catch - AGMI is tiny. With assets well under $10 million, you need to think about liquidity. Bid-ask spreads can be wider on small funds, which eats into returns when you buy and sell. There's also the question of fund viability: very small ETFs sometimes close if they don't gather enough assets.

Bottom line: AGMI is interesting for cost-conscious, long-term investors who plan to buy and hold. If you're trading actively or moving large positions, the liquidity constraints could be problematic. But if you're building a position over time and plan to sit on it, that 0.35% expense ratio is hard to beat.

How Do They Stack Up?

6 Silver mining ETFs compared by AUM (assets under management), Expense Ratio (what they charge) and Performance (year-to-date returns in 2025).

ETF | AUM | Expense Ratio | Performance | Best For |

|---|---|---|---|---|

SIL (benchmark) | $4.1B | 0.65% | +146% | Maximum liquidity, established track record |

SILJ (benchmark) | $3.1B | 0.69% | +162% | Junior miners, higher risk/reward |

SLVP | $662M | 0.39% | +177% | Cost-conscious global exposure |

SLVR | $453M | 0.65% | +145% | Hybrid miner + physical silver approach |

GBUG | $134M | 0.89% | +106% | Active management, gold + silver blend |

AGMI | $7M | 0.35% | +153% | Lowest cost, buy-and-hold investors |

The Big Picture

Silver miners have crushed it in 2025 - many of these funds are up over 100%+ year-to-date. With all-in sustaining costs (what it costs to pull an ounce out of the ground) running around $15-18/oz for most producers, and silver trading near $58, margins are extraordinary.

But here's the thing: you don't need to pick just one fund. A reasonable approach might be:

Core position in SIL, SILJ or SLVP for liquidity and diversification

Satellite position in SLVR if you like the hybrid approach

Small allocation to AGMI for cost efficiency (if you can stomach the size risk)

As always, do your own homework and consider your personal situation. But if you're looking to invest in silver for the long-term, these alternatives give you some great options beyond the obvious choices.

That’s all for this Tuesday, folks. See you Thursday.

Before you go, please take a moment to rate today’s newsletter and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com