Happy Tuesday, GoldBuzzers!

The Fed's December rate cut drama has turned from a sure thing into a nail-biter, with gold holding the line above $4K despite the uncertainty.

In today’s Company Corner, I’ll be lifting the lid on the silver miners ETF that's been printing money for anyone brave enough to ride its wild swings. With silver up 78% this year and industrial demand going parabolic, I'll show you why this volatile beast might be one of the most interesting plays in precious metals right now.

Ok, let's dive in.

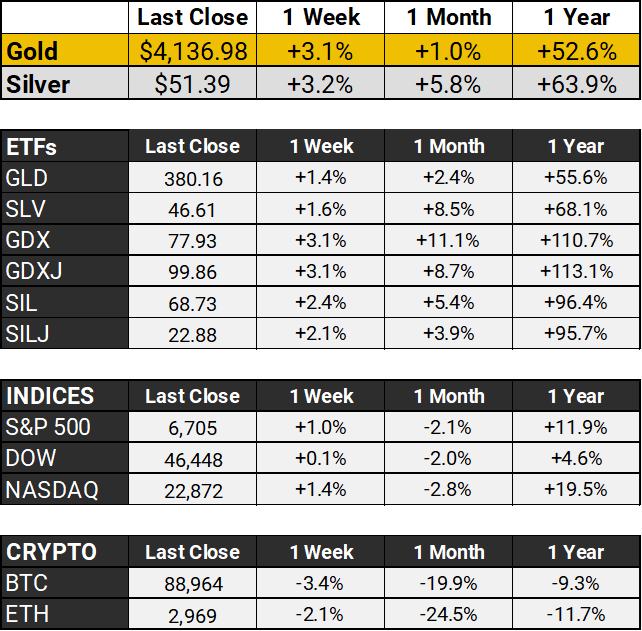

The Scoreboard 🏆

Bullion Battles Above $4K as Fed Drama Heats Up

Gold clawed its way back to close around $4,136 per ounce on Monday after dipping toward $4,050 in early Asian trading, as the December Fed rate cut odds just went from "slam dunk" to "coin flip" faster than you can say "government shutdown."

New York Fed President John Williams signaled he could support a cut on Friday, sending the probability of another quarter percentage point reduction at the Dec. 9-10 meeting soaring to around 72% - though that's still way down from the near-certainty markets were pricing in just weeks ago.

The missing October jobs data (thanks to that record-breaking shutdown) has left the Fed flying blind, with "many" officials saying that no more cuts are needed at least in 2025 according to the latest minutes. Meanwhile, Asian investors - particularly in South Korea, China and Japan - have continued pouring money into local gold ETFs, helping keep a floor under prices even as the AI rally tries to steal some of gold's thunder.

With gold up 58% year-to-date, silver up 78% and central banks still backing up the truck, precious metals continue holding their own in this tug-of-war between rate cut hopes and dollar strength - proving once again that when the macro picture gets messy, gold and silver still glitter.

Company Corner 🏢

Navigating the 2025 Silver Surge with SIL

It turns out you guys really enjoyed those recent deep dives into the big mining ETFs. Here’s the full set if you want to revisit: GDX, GDXJ and SILJ.

But there's one glaring omission: SIL, and I’m going to rectify that for you today.

So what is SIL?

SIL is the Global X Silver Miners ETF - a fund that owns 40 of the big silver companies for you, with Wheaton, Pan American and Coeur making up around 40% of the fund. It's a turbo-charged bet on the companies digging up the white metal that's powering everything from your iPhone to Tesla's battery pack and its current market cap is $3.7 billion.

SIL TOP HOLDINGS

After rocketing to $80.72 mid-October, SIL has pulled back to the $68 range - creating a possible golden (or should we say silver?) entry point. With year-to-date gains of 117%, this ETF has absolutely crushed it in 2025, riding the wave of silver's industrial renaissance.

The Setup: Why Silver Miners Are the Trade

As I discussed last Thursday, while everyone's obsessing over AI stocks, silver's quietly becoming the MVP of the green revolution. Solar panels? Can't make 'em without silver. EVs? Loaded with the stuff. 5G infrastructure? Silver's all over it. And the beauty is that miners like Pan American Silver (PAAS) and Wheaton Precious Metals (WPM), which make up the backbone of SIL's holdings, are leveraged plays on silver prices. When silver moves 10%, these stocks often move 20-30%. It's like options without the expiration date.

The Technical Picture: Coiled Spring or Dead Cat?

The options market is screaming bullish - call open interest on sister ETF SILJ is crushing puts at a 7-to-1 ratio. That's institutional money betting on a breakout, not retail hope. But the reality check is that Silver needs to crack $55 per ounce for this party to really get started.

The Risk/Reward: Not for the Faint of Heart

Let's be crystal clear - SIL isn't a widows-and-orphans fund. With a 60-month beta that'll make your head spin and daily swings that can hit 4-5%, this is volatility on steroids. The recent pullback from $80 is a reminder that when silver sneezes, silver miners catch pneumonia.

10 YEAR PERFORMANCE OF SILVER (Black) vs SIL (Blue)

The 10 year chart shows SIL has outperformed silver, and as you’d expect, it’s performance is much more volatile than the metal itself.

But let’s remember that miners are trading at valuations that should make value investors weep with joy. They're printing cash at current silver prices, most have cleaned up their balance sheets since the last cycle, and with industrial demand for silver growing faster than a teenager's appetite, the fundamentals are actually backing up the technicals for once.

The Bottom Line

SIL offers a liquid, diversified way to play the silver story without the headaches of picking individual miners or storing physical metal. At current levels, you're essentially betting that the AI and green revolutions aren't a fad and that central banks will keep printing money like it's going out of style (spoiler: they will).

With 1-year net flows hitting $1.01 billion, that’s an indicator that serious money continues to accumulate on weakness. But it’s not a set-it-and-forget-it play. Watch silver's $55 level like a hawk, keep an eye on industrial demand indicators, and be ready to take profits when the crowd starts piling in.

In a world where everything's getting electrified and digitized, silver isn't just money - it's the grease that keeps the tech revolution spinning. And SIL? It's a ticket to ride that wave, with leverage. Just make sure you've got the stomach for it.

That’s all for today, folks. See you Thursday.

Before you go, please take a moment to rate today’s newsletter and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com