Happy Sunday, GoldBuzzers!

It was a thrilling two-horse race this week: Silver gunning for $100, Gold charging toward $5,000. Silver got there first - closing above $103 and making history. Gold's still knocking on the door above $4,980, but let's be honest, that's a hell of a consolation prize.

For those of us who've been living and breathing these markets for years, none of this is a surprise - it was always a question of when, not if. But watching it unfold in real time? Still gives you goosebumps.

This week I'm going to unpack what these historic moves actually mean, and then turn to where the real leverage lives - the companies that dig the shiny stuff out of the ground. Because when the metals rip like this, the miners are where fortunes get made (and lost).

Let's dive in.

Today’s Vibe 😂

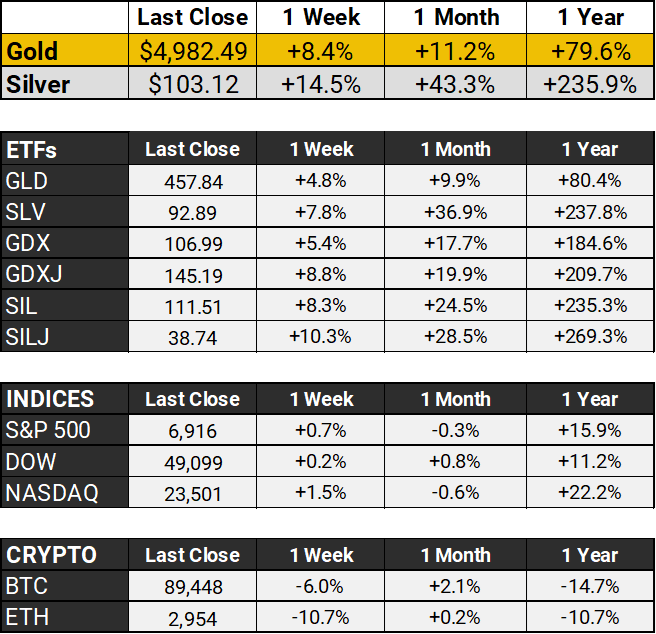

The Scoreboard 🏆

Silver Smashes $100, Gold Flirts with $5K 🚀

Gold posted its strongest weekly performance since the COVID panic of March 2020 and the macro backdrop remains firmly in gold and silver's corner. The dollar's getting smacked around by U.S.-Europe tensions over Greenland (President Trump says he's secured "permanent access" through NATO; Denmark says not so fast), and PCE inflation came in right where expected, giving the Fed zero reason to deviate from the script.

Personally, I think the rate decision next week is a formality - they're holding - but markets are still pricing in two cuts later this year, and all eyes are on who Trump picks as the next Fed chair. A Fed chair who’s friendly to much lower rates could pour more gasoline on this rally.

But the real headline grabber? Silver didn't just break $100 - it obliterated it, surging past $103 with a 7% gain on Friday and making history while half the financial world was still debating whether triple digits were even possible in 2026.

The move has been turbocharged by a historic short squeeze, relentless retail buying, and China tightening export controls on critical metals. The gold-to-silver ratio has compressed around 50:1 for the first time in 14 years - a signal that silver is finally shaking off decades of underperformance relative to its golden sibling.

Goldman just bumped their year-end gold target to $5,400, implying plenty of runway left for those who pay attention to those reports. If you've been stacking, your patience is paying off. If you haven't... the train's running, and tickets aren't getting any cheaper, but we’re nowhere near our ultimate destination. 🥇

Deep Dive 🔍

The Magnificent Miners Awakening: Why Gold and Silver Stocks Are the Real Breakout Story

Take a look at The Scoreboard above and you’ll notice that Gold’s 80% gain in the past year is dwarfed by the 185% and 210% gains of GDX and GDXJ (the two biggest gold mining ETFs). Silver’s crazy 236% gain is eclipsed only by SILJ’s 269% increase.

However, this outperformance of the gold and silver mining companies is a relatively recent phenomenon. For years, they have notoriously been the worst performing sector in the entire stock market.

What I learned from Theseus

After four years buried in 55 years of price data, what became crystal clear to me was that gold, silver, and the miners don't play by the same rules.

Theseus started as a deep dive into the silver markets, but I later extended the methodology to apply to gold, the mining stocks (and eventually Bitcoin). The differences were striking.

Silver moves fast. The technical factors that best predicted silver's price showed up clearly on daily and weekly charts - short, sharp, and tradeable.

Gold takes its time. The signals that mattered most for gold became strongly visible on weekly and monthly time frames. It's a slower, more deliberate beast.

The miners? They're their own animal. While gold and silver stocks inherit some characteristics from the underlying metals, they move in very different cycles. The profitable windows are shorter than for the metals themselves - but considerably more explosive. When miners run, they run.

I’ve been investing with these real-time signals myself for over a year. They will be available in the coming weeks.

The bottom line: timing matters differently depending on what you're trading. And if you're in miners, you need to be ready to move when the window opens.

Built-In Leverage

As well as operating on different cycles, mining stocks don't move in lockstep with spot prices. They amplify them.

A miner's costs stay relatively fixed - labor, equipment, diesel, permits. Revenue per ounce moves with the metal price. This creates operating leverage that can turn a 2.5x move in gold into a 6x or 8x move in profit margins.

Consider a major producer with all-in sustaining costs (AISC) around $1,600/oz. When gold was $2,000 back in early 2024, they pocketed roughly $400 per ounce. At today's $5,000? That's $3,400 per ounce - an 8.5x increase in profit margin from a 2.5x move in gold.

The cash is gushing. Newmont generated a record $1.6 billion in Q3 2025 alone, bringing year-to-date free cash flow to $4.5 billion - and they've reached near-zero debt after retiring $2 billion. Barrick's operating cash flow jumped 20% to $4.49 billion for 2024, with free cash flow more than doubling to $1.32 billion.

Veteran investor Doug Casey recently called mining stocks "the most explosive opportunity of my lifetime." When capital floods into this tiny sector, he warned, it's like "trying to force the contents of Hoover Dam through a garden hose."

This Has Happened Before

During the 1970s bull market, gold ran from $35 to $850 - a 24x move. Mining stocks captured the leverage. The Barron's Gold Mining Index returned +1,247% from 1969 to 1980 while the S&P 500 managed just 43%. During the brutal stagflationary crash of 1973-74, when the S&P 500 fell 48%, the mining index rose 193%. In the final sprint of 1978-1980, many of the large producers ran from under $5 to over $25 - 400%+ gains in barely two years.

In the early 2000s cycle, miners climbed even when gold briefly dipped during the 2008 financial crisis. Operational improvements and rebounding demand kept them moving while spot prices stalled.

The mechanism is consistent: Miners get beaten down during bad times, then offer amplified returns when metals recover.

The Oil Factor

Mining chews through energy. Diesel fuels trucks. Electricity powers mills. In some operations, energy accounts for 20-30% of total production costs.

When oil prices drop, miners keep more of every ounce they sell. A 10% decline in crude can boost miner earnings by 5-15%, depending on the operation.

Right now, energy prices sit relatively subdued while metal prices hover at all-time highs. The result is margin expansion that would make most industries envious.

Still Priced Like Gold Never Left $2,000

Despite gold's roughly 150% rally since the 2024 breakout, many miners remain strangely cheap. Barrick trades at a forward P/E around 14 - about two thirds less than the S&P 500's average around 23 - despite sitting on around $5 billion in cash reserves.

The ratio of silver mining stocks to silver itself recently hit multi-year lows. That's happening while silver trades above $100 for the first time in history.

Why the disconnect? Years of capital misallocation and spectacular blowups left investors scarred. Many investors remain skeptical of mining companies due to historical blunders like Barrick Gold's staggering $21 billion in cumulative writedowns between 2012 and 2013, stemming from overpriced acquisitions during the previous gold boom and subsequent asset devaluations amid plummeting metal prices.

But today's miners look different. Balance sheets are cleaner. Newmont ended Q3 2025 with near-zero net debt. Cost discipline is real. Companies generating record free cash flow are being valued as if gold were still at $2,000.

Where We Are

We know that central banks stacked record gold in 2024 and 2025 - over 1,000 tonnes per year. Industrial silver demand from solar panels, EVs, and AI infrastructure keeps climbing. Silver's rally has been fueled by a historic short squeeze and strong retail buying.

Mainstream investors? They’re still mostly absent.

Here's a stat that should really make everyone do a double-take: all the gold ever mined - every bar in every vault, every coin, every ring - is now worth over $34 trillion. As I mentioned on Thursday, that's larger than Nvidia, Apple, Microsoft, and Amazon combined.

Yet the companies that actually dig this stuff out of the ground? The entire publicly traded gold mining sector is worth less than $1 trillion. Apple alone is roughly 3x the value of every gold miner on the planet put together. That means that miners are priced like gold is still at $1,500/oz. When the market wakes up to this absurd disconnect, mining stocks have a lot of catching up to do.

Gold and silver are having their moment. But miners offer something the metals can't: operational leverage, expanding margins, and prices that are nowhere near the value of the underlying commodity.

I'm not suggesting you pile into junior explorers blindly - plenty of the smaller ones will go to zero. But the gap between metal prices and mining stock valuations is wider than it's been in years.

The opportunity isn't underground anymore. It's sitting on exchanges, largely ignored.

As you probably know by now - I don't just write about this stuff - I own it too. BullionVault is where I hold a chunk of my personal metal because it's allocated, audited daily, and I can choose exactly where it's vaulted.

Nuggets 💰

Some stories that you might have missed.

A metal detectorist in Germany found 450 Roman silver coins plus a gold ring back in 2017 - then kept the 2,000-year-old haul secret for eight years before finally fessing up to authorities (thankfully the statute of limitations saved his bacon). Fox News

University of Michigan archaeologists just unearthed a pot of 2,500-year-old Persian gold coins in Turkey - ancient "payroll" for mercenary troops that experts are calling a find "of the highest importance." University of Michigan

That’s all for this Sunday, folks! I’ll see you on Tuesday.

Before you go, please take a moment to rate today’s GoldBuzz and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com