Happy Sunday, GoldBuzzers!

Just another week. Gold punched through $4,500, silver went on a wild ride toward $80, and the jobs report landed in that sweet spot that has precious metals investors grinning.

In today’s weekly wrap-up, I’ll be diving deep into the US policy playbook that's turned gold and silver into the hottest trade of this decade. Plus, we'll reveal what you predicted for silver's 2026 high (spoiler: the bears didn't last a week).

Let’s get to it!

Today’s Vibe 😂

The Scoreboard 🏆

Gold and silver closed the week like a heavyweight boxing match - bruised but still standing tall. Gold rose to above $4,500 per ounce Friday, paring early losses as December nonfarm payrolls rose by just 50,000 - below forecasts of 60-73K. The unemployment rate fell sharply to 4.4%, confirming a low-hiring, low-firing environment that supports lower interest rates without signaling major labor market stress.

This Goldilocks jobs report (not too hot, not too cold) sparked renewed demand for non-yielding assets, with gold holding onto a weekly gain of 4% despite the dollar flexing its muscles. Meanwhile, silver went full rollercoaster mode - rising nearly 10% toward $80 per ounce on Friday after getting absolutely hammered earlier in the week by commodity index rebalancing flows.

The white metal's volatility made Bitcoin look stable, but silver bulls emerged victorious as mechanical selling linked to index rebalancing began to subside. With China's central bank extending its gold-buying streak to 14 months and geopolitical tensions around Venezuela and Iran keeping the fear trade alive, both metals are positioning for what could be an explosive 2026.

HSBC is already calling for gold to potentially hit $5,050 in H1, while Bank of America suggests silver could rocket anywhere between $135-$309.

Buckle up, GoldBuzzers - the ride's going to be bumpy but it’s still just getting started! 🚀

Deep Dive 🔍

The New Policy Playbook Driving the Precious Metals Surge

Let me be clear upfront: GoldBuzz isn't a political newsletter. Our readers span the US, UK, Canada, and more than 30 other countries - with every political view you can imagine. What unites us all is making informed investment decisions and protecting our financial futures. And right now, that means understanding US policy, because what happens in Washington moves precious metals markets worldwide.

Here's the reality: government policy is one of the most powerful fundamental drivers of precious metals prices. Ignoring it because it feels "political" is like ignoring interest rates because you find the Fed boring. You can tune it out, but your portfolio won't.

Consider this practical example: In August 1971, President Nixon closed the gold window, ending dollar convertibility. Investors who dismissed it as "just politics" watched gold surge from $35 to $850 over the next decade - a 2,300% move. Those who understood the monetary implications positioned accordingly.

As soon as those fundamentals were in place, then the technical indicators confirmed them. The same principle applies today.

Whether you love or loathe the current administration, their policies on tariffs, Federal Reserve appointments, and geopolitical maneuvering are creating real, measurable impacts on gold and silver prices. Our job as investors isn't to judge those policies - it's to understand them and position our portfolios accordingly.

With that framework in mind, let's break down what's actually happening and why precious metals have been on such a tear...

Since President Trump's inauguration on January 20, 2025, gold has surged from around $2,700 to over $4,500 per ounce - a staggering 67% gain. Silver? Even better. It rocketed from $30 to almost $80, a 167% increase that's made believers out of skeptics.

Meanwhile, Bitcoin and Ethereum have dipped 8%. The rotation into hard assets is unmistakable.

So what's driving this? Three words: Trump's economic agenda.

Tariffs: The Inflation Engine

The administration's tariff playbook has been jet fuel for precious metals. We're talking up to 245% tariffs on Chinese goods, including 125% reciprocal duties and 100% penalties to combat fentanyl trafficking.

China's response? Dumping U.S. Treasuries and hoarding gold. Classic de-dollarization in action.

Meanwhile, the Supreme Court was due to rule on the legality of the tariffs on Friday, but that decision has now been postponed to next Wednesday.

The uncertainty is pushing investors toward gold and silver as hedges against inflation and a weakening dollar. J.P. Morgan now forecasts gold averaging even higher through 2027, driven by tariff uncertainty, ETF inflows, and relentless central bank buying.

Silver gets a double boost here. As an industrial metal powering solar panels, EVs, and AI infrastructure, supply chain disruptions hit it twice - once as a safe haven, once as a critical commodity.

Geopolitical Chess Moves

Trump's foreign policy has added rocket fuel to the rally.

The capture of Venezuela's Maduro has shone the spotlight on resource-rich territories. There are revived talks about acquiring Greenland for its rare earths. There’s talk about reclaiming the Panama Canal. Not to mention ground operations in Mexico - home to the world's largest silver production.

These moves signal a U.S. pivot toward securing critical minerals, backed by a $7.4 billion investment in a Tennessee refinery, that I discussed on Thursday.

With U.S. debt topping $38 trillion and interest costs now outpacing defense spending, this "geopolitical adventurism" creates what analysts call a structural bid for safe-haven assets. Every time sovereign reserves get threatened, central banks accelerate their gold hoarding.

The Fed Factor

Trump is pushing for Kevin Hassett to lead the Fed with a mandate to slash rates to 1% - far below the ECB's 2%+ or the Bank of England's 3.75%. That kind of rate differential could hammer the dollar further.

Add in the proposed stimulus: a $200 billion mortgage securities buyback, $2 trillion in tariff-funded checks, and a 50% defense budget hike to $1.5 trillion.

This liquidity flood screams debasement. Some pundits are even floating a 1930s-style gold revaluation. And a February executive order allowing 401(k)s to include precious metals? That could channel billions from $7.5 trillion in retirement assets directly into gold and silver.

What's Next?

The consensus is clear: 2025's rally isn't a blow-off top. It's the beginning.

State Street sees gold consolidating at $4,000–$4,500, supported by Fed easing and geopolitical risks. Bolder calls put gold at $5,000–$6,700 and silver at $100–$150 by year-end.

Mining stocks remain criminally undervalued, offering leveraged upside as profit margins explode.

Short-term? Watch for Bloomberg Commodity Index rebalancing this week - potentially $5–6 billion in gold futures selling and $4–5 billion in silver. Corrections happen. But with structural tailwinds like accelerating U.S. debt and yield curve control on the horizon, the trend remains decisively up.

Bottom Line

President Trump's policies are rewriting the rules, turning precious metals into must-haves for portfolio protection. The dollar is under siege, global tensions are rising, and 2026 could make last year look tame.

Your Take 🤔

Last Sunday, I asked you to predict the highest Silver price this year.

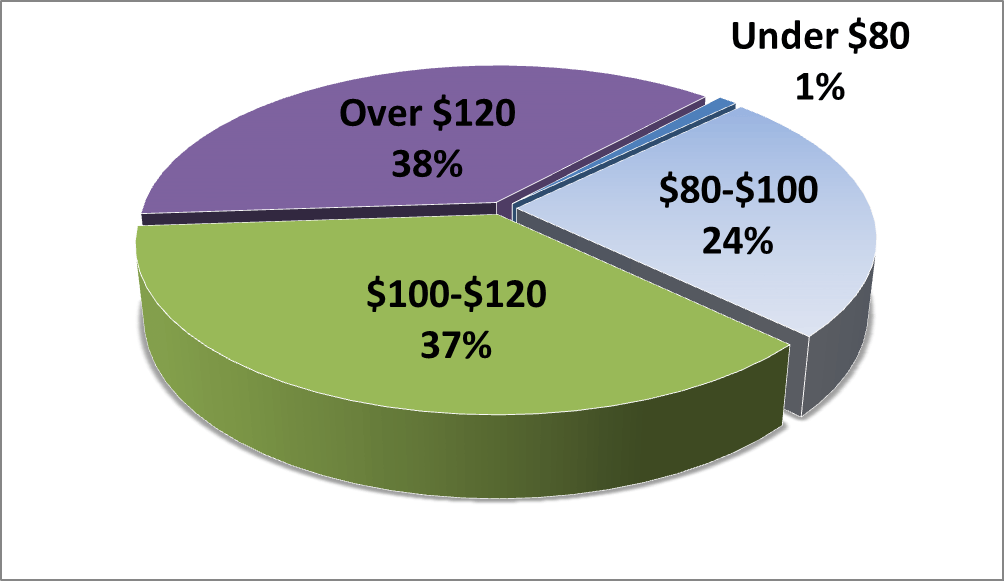

It was a narrow win for 'over $120' which pipped '$100-$120' by one point. Almost a quarter of you went for '$80-$100' and a plucky 1% of non-believers chose ‘under $80’. Sadly for those skeptics, silver blew past $81 last Tuesday and was higher by Wednesday - their prediction didn't even survive the week.

What will the Silver high be in 2026?

That’s all for this Sunday, folks! I’ll see you on Tuesday.

Before you go, please take a moment to rate today’s GoldBuzz and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com