Happy Thursday, GoldBuzzers!

If you survived this week with your positions intact, congratulations. But overnight on Wednesday, Silver was slammed again so the shenanigans that we saw on Friday aren’t over yet.

But the wildest price action since 2008 isn't the only story - there's a policy shift happening in Washington that could matter a lot more for where we're headed.

Let's get into it. 👇

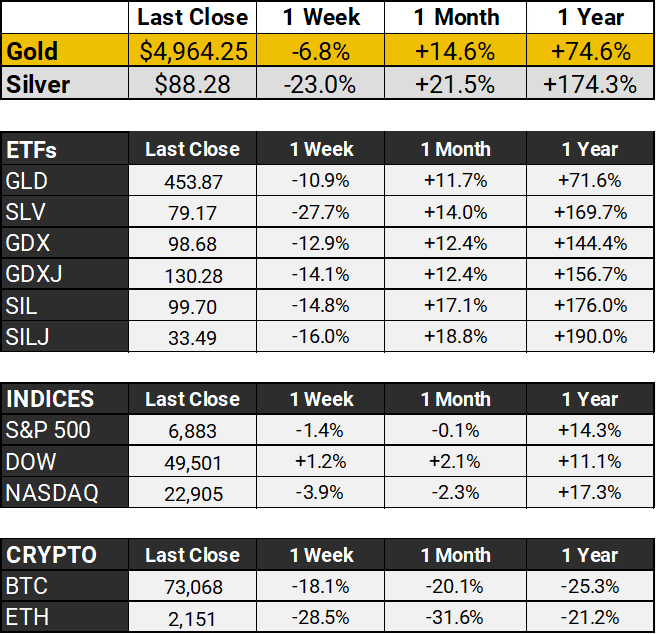

The Scoreboard 🏆

Gold pulled back slightly on Wednesday to trade just under $5,000, catching its breath after Tuesday's monster 6% surge - the biggest single-day jump since 2008. If you blinked last week, you missed gold touching record highs above $5,600 before a brutal selloff dragged it down to $4,405 by Monday - the kind of volatility that sends weak hands running for the exits and shrewd money reaching for their wallets.

Silver's been even wilder, recovering toward $90 after a historic two-day selloff wiped out as much as 40% of its value - forced liquidations appear to have finally eased as dip buyers stepped in.

The backdrop? Trump tapped Kevin Warsh as the next Fed chair (more hawkish than the market wanted), ADP payrolls came in soft while services PMI beat expectations, and the US Navy shot down an Iranian drone in the Arabian Sea - though the White House insists US-Iran talks are still on for Friday. The structural supply deficit and steady industrial demand that have been driving this bull market haven't gone anywhere.

And today, we’re going to get Barrick’s long-awaited earnings call. I’m anticipating those numbers to be more than healthy!

Real Talk 🎯

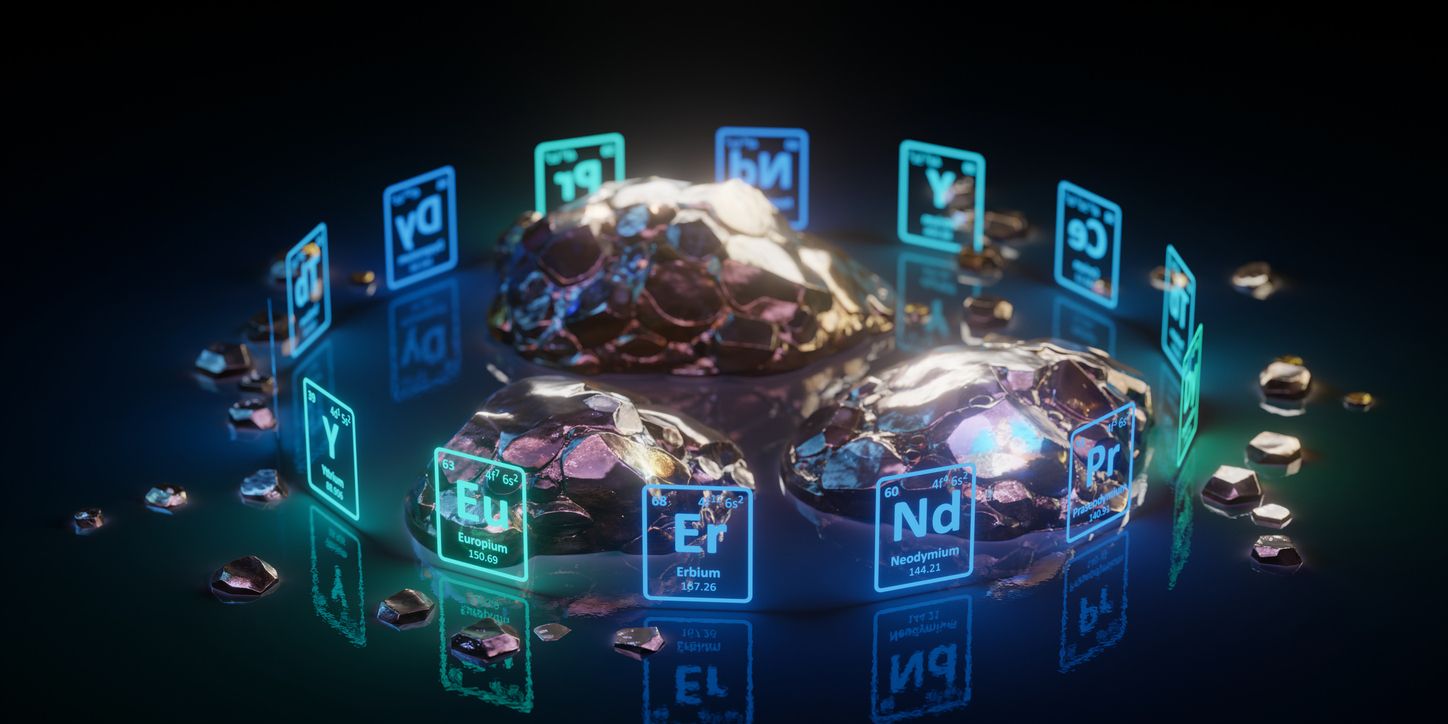

Vance Wants a 'Critical Minerals Club.' Gold's Not Invited - But Silver Is.

You've probably seen the clip. VP JD Vance standing at the State Department on Tuesday, telling 55 countries that America wants to build a "preferential trade zone" for critical minerals with enforceable price floors.

Understandably, the gold community went nuts. Is this the end of paper market suppression? A step toward metals-backed currencies?

Probably not. But it's not nothing, either.

In fact, I believe it’s part of a much larger strategic picture.

What Vance Actually Said

The pitch is simple: form a trading bloc with allies, use tariffs to enforce minimum prices, and stop China from dumping cheap supply to kill off competitors. Beijing controls 90% of rare earth processing, and the administration is done pretending that's fine.

"We want members to form a trading bloc among allies and partners," Vance said. "What is before all of us is an opportunity at self-reliance - that we never have to rely on anybody else except for each other for the critical minerals necessary to sustain our industries."

The EU, Japan, and Mexico already signed on. Another 30 countries want in. Interior Secretary Doug Burgum is calling it a "critical minerals club."

Project Vault

This comes days after Trump launched "Project Vault" - a $12 billion stockpile funded by $10 billion in EXIM Bank loans plus private capital. The government is building a strategic reserve for minerals like we've had for oil. That's new.

And if you want proof this isn't just talk, look at the Korea Zinc deal from December that I discussed last month. The Pentagon is taking a 40% stake in a $7.4 billion smelter being built in Tennessee - the first large-scale zinc facility the U.S. has constructed since the 1970s. The government is putting up $1.4 billion directly, plus another $4.7 billion in loans.

Here's the part that matters for us: the facility will process 13 different minerals, and the list includes gold and silver alongside zinc, copper, antimony, gallium, and germanium. Commerce Secretary Lutnick wasn't subtle about it - he posted on X that "starting in 2026, the United States will have priority access to Korea Zinc's expanded global production."

The US government isn't just talking about securing mineral supply chains. They're writing checks.

Where Silver Fits

Silver made the USGS Critical Minerals List for the first time in November. Why? Solar panels, EVs, electronics, defense - industries now eating 12%+ of global supply every year. We've had four straight years of deficits. Probably five after 2025.

That designation means the feds are now supposed to care about domestic silver supply chains. Faster permitting. Potential subsidies. Maybe stockpiling. If price floors get established for critical minerals broadly, silver is in the conversation.

What About Gold?

Gold's not on the list. It's a monetary metal, not an industrial one.

But the key point here is that most U.S. silver comes as a byproduct of gold mining. Anything that helps domestic silver producers - Hecla, Coeur, the smaller names - helps gold operations too. Same mines, same permits, same infrastructure.

And zoom out a bit. The U.S. government just launched a $12 billion commodity stockpiling program. Central banks bought over 1,000 tonnes of gold last year. Washington is treating raw materials as strategic weapons. None of that is bad for gold.

On top of that, here’s another key piece.

Don’t forget this cryptic statement made by Treasury Secretary Scott Bessent back in October, likely hinting that the US is on course for a monetary reset in some form involving Gold in 2026.

What to Make of It

On the surface, Vance's speech wasn't about gold and silver. But it tells you where the wind is blowing.

Silver now has official "critical mineral" status. That's real. A year ago it didn't exist. Gold benefits from anything that boosts domestic mining.

And the much bigger picture is this: $12 billion stockpiles, global trading blocs for commodities, governments treating resources as geopolitical leverage, and hints that the US is planning to revalue its gold.

That's a world where you want to be holding metal, not paper.

That’s all for this Thursday, folks. See you on Sunday.

Before you go, please take a moment to rate today’s newsletter and let us know how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com