Happy Tuesday, GoldBuzzers!

We’re not even two weeks into the New Year, and Silver’s already up 19%!

As I’ve been saying for months, the financial world is shifting right in front of us.

Last week we launched Take Action Tuesday and the response blew me away. You want real, practical ways to position yourself in this extraordinary and unprecedented bull-market. So, today I’m walking you through one of the best platforms I actually use myself.

Ok. Let's dive in.

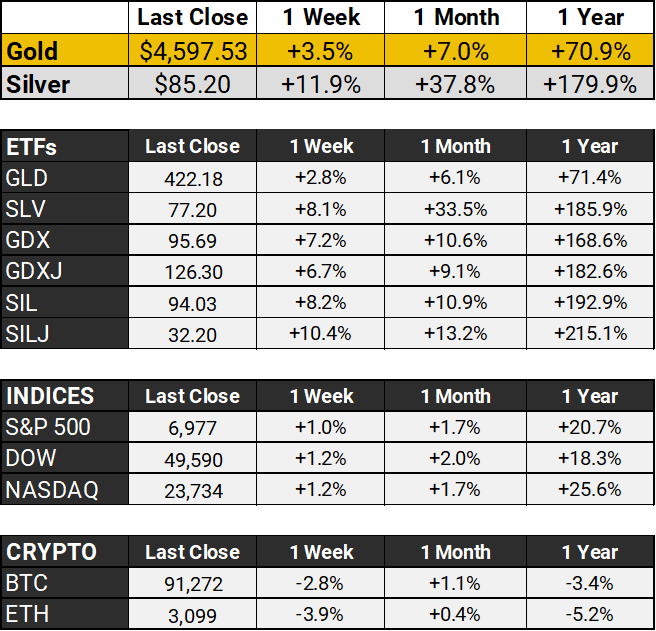

The Scoreboard 🏆

BOOM! Gold Shatters Records as Fed Drama and Global Chaos Send Metals Moonbound 🚀

Holy precious metals, Batman! Gold blasted through $4,600 per ounce like a runaway freight train on Monday, while Silver briefly touched $86, both hitting fresh all-time highs as the markets go full "safe haven or bust" mode.

The catalyst? Fed Chair Jerome Powell dropped a bombshell Sunday night revealing he's under criminal investigation - yes, you read that right - with Powell claiming it's all about Trump pressuring the Fed to slash rates faster. Powell confirmed federal prosecutors launched a criminal probe, calling it part of Trump's push to pressure the Fed to lower interest rates.

Meanwhile, Iran's erupting in protests with at least 62 people killed in demonstrations that began over the economy and morphed into the most significant challenge to the government in years, and Trump's threatening military intervention if things get bloodier.

With traders pricing in two Fed cuts this year, geopolitical tensions escalating by the hour, and institutional investors scrambling for safety, both metals are primed for a lot more upside - though don't be shocked if we see some wild swings as this drama unfolds.

2026's starting with a bang! 💥

Take Action Tuesday 📅

Where I Actually Keep My Gold:

BullionVault

Last week I covered the five ways to own precious metals. The second option was "allocated storage" - owning specific bars in professional vaults while someone else handles security.

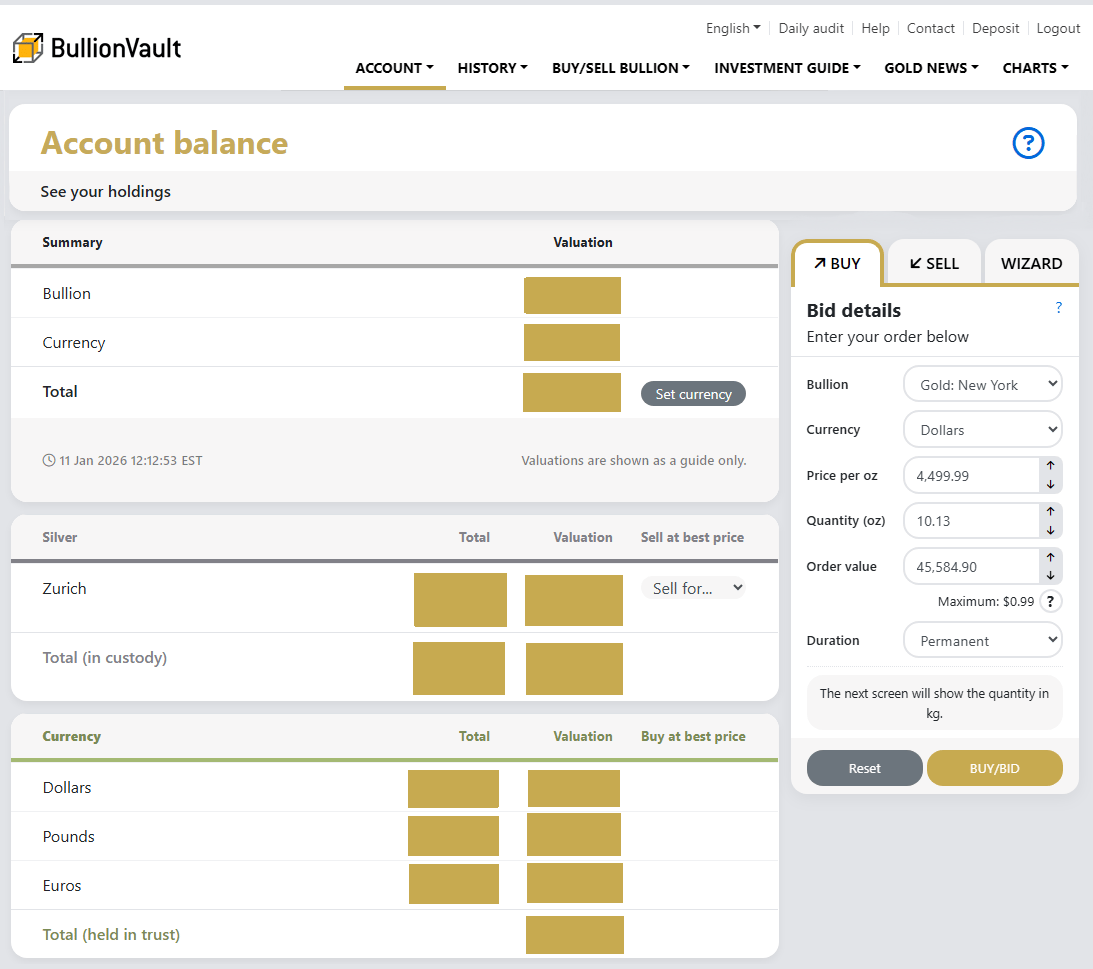

A lot of you asked what platform I actually use for this. The answer: BullionVault. I've been actively trading on it for a while, so here's my honest take - the good and the bad.

⚡ QUICK FACTS

Company: | BullionVault |

Founded: | 2005 (UK) |

Minimum: | ~$20 |

Storage Fee: | 0.12%/year (gold) |

Credentials: | Full member of the LBMA and 3 time winner of The Queen’s Award for Industry |

Vaults: | London, Zurich, New York, Toronto, Singapore |

What Is BullionVault?

Instead of buying coins from dealers with hefty markups, BullionVault lets you buy grams of gold directly from LBMA-accredited Good Delivery bars at near-spot prices.

The key difference: you own allocated metal. Not a claim. Not a certificate. Actual gold with your name on it.

Your metal sits in your choice of five vaults across different legal jurisdictions (US, Canada, UK, Switzerland, Singapore). It’s what makes this way of buying precious metals so appealing - more on that below.

The Fee Structure

Fee Type | Gold | Silver |

Trading Commission | 0.5% (drops to 0.05% at volume) | 0.5% |

Annual Storage | 0.12% (min $4/mo) | 0.48% (min $4/mo) |

Insurance | Included | Included |

Wire Out | $30 | $30 |

⚠️ The $4/month minimum means this works best for holdings above ~$3,500. Below that, fees eat into your position.

✅ PLUS

Multiple jurisdictions - Zurich vault is outside US/UK legal reach

Near-spot pricing - No dealer premiums

24/7 trading - Including weekends

Daily independent audits - BullionVault is the only allocated bullion business I’m aware of that publishes a Daily Audit Online

Mobile app available - iOS and Android

19 years operating - Survived 2008, COVID, every crisis since 2005

Physical delivery available - If you ever want to take possession

❌ MINUS

$4/month minimum - Inefficient for very small holdings

Dated UI - Functional but not pretty (mobile app is better)

Silver storage 4x gold - 0.48% vs 0.12%

Delivery is complex - Expensive and slow if you want physical

Foreign account reporting - May trigger FBAR filing if over $10k (see below)

Why I Use It

I keep a portion of my stack in BullionVault's Zurich vault.

Why Switzerland? It's outside the direct legal reach of both US and UK governments. After watching Russian reserves get frozen overnight in 2022, jurisdictional diversification isn't paranoia - it's prudent. However, you can choose to have your bullion stored in London, New York, Toronto or Singapore vaults if you prefer.

As with most platforms, opening your account takes a little time, but after that’s done, I’ve found the trading itself to be quite straightforward. There’s a Live order book - you can place limit orders - and trades execute in seconds. When silver pulled back early in the New Year, I added to my position at 5am - try doing that with your local coin dealer!

For US Readers

Since many of our readers are US-based, and BullionVault is a UK company, here are a few things to put your mind at rest:

You're not alone - Nearly 25% of BullionVault's 120,000 active clients are American. This isn't some obscure overseas operation - they’re a huge company ($7 billion in orders.)

US banking - They hold US accounts at Wells Fargo for US dollar deposits. So, you're wiring to a US bank, not sending money overseas and when you withdraw funds, your money’s wired to you the next business day.

No sales tax - Gold purchases have zero sales tax. Silver and platinum are also tax-free while stored in vault.

IRA compatible - Works with Self-Directed IRAs if you want tax-advantaged gold exposure.

One heads up: If your account exceeds $10,000, you may need to file an FBAR (Report of Foreign Bank and Financial Accounts). Over $50,000 may require Form 8938. BullionVault addresses this directly in their US residents FAQ. It’s not complicated, but worth knowing upfront.

💰 Don't Have $4,500 for a Gold Coin?

A common email I get is: "I want to buy gold, but I can't afford a full ounce and I feel like I’m missing out on the bull market.”

Fair point. A 1 oz Gold coin is the best part of $5,000 right now. That can be intimidating if you're just starting out.

This is precisely where I think BullionVault shines: you can buy as little as 1 gram at a time. Just set up a regular weekly or monthly purchase of whatever you can afford ($50, $100, $200) and dollar cost average your way into a position.

Yes, the $4/month minimum fee bites harder on smaller balances, but think of it as paying for vault storage while you build. After a year or two of steady buying, suddenly you've got a real stack - stored in a professional vault - and the fee becomes negligible. Doing that will put you ahead of most investors.

That’s exactly how I'd tell my younger self to start.

👤 BullionVault is best for:

Those wanting storage outside their home country

People who prefer spot prices over dealer markups

People who appreciate being able to buy small amounts at any time

Long-term holders who don't need physical possession

🎯 Rick's Take

BullionVault isn't for everyone. Want to hold gold in your hands during a crisis? Buy coins and a safe instead. (You can take physical delivery from BullionVault but it’s not their core business.)

However, if you want professional vault storage with jurisdictional diversification - the same setup used by central banks and wealthy families - BullionVault makes it easily accessible to all budgets.

I use it as one important layer alongside physical coins. Different tools for different risks.

🎁 Try It Risk-Free

I recommend giving it a try. New accounts get 4 FREE grams of silver deposited automatically. No obligation to fund.

I've used BullionVault since before GoldBuzz existed. If you sign up through my link, I earn a small commission - it's what helps keep this newsletter free. You get 4 free grams of silver. Fair trade.

PS: The free silver offer won't last forever - grab it here before they change it.

That’s all for this Tuesday, folks. I’ll see you on Thursday.

Before you go, please take a moment to rate today’s newsletter and tell us how we did.

What did you think of today's GoldBuzz?

Enjoyed today's issue? Forward it to a friend who needs more gold in their life. They can subscribe at goldbuzz.com

Got feedback? Hit reply and let me know what you loved (or didn't).

The Gold Awakening Download Your Free Copy Here

Rick Adams

Founder, GoldBuzz

rick@goldbuzz.com